Trump’s Year One Economy

Week of January 19th, 2026

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: A Busy Time For Robotics, Defense Tech And AI (Crunchbase, 5 minute read)

Skild AI (Robotics): Skild AI raised $1.4 billion in a SoftBank-led round, tripling its valuation to over $14 billion. Based in Pittsburgh, the company is building an “omni-bodied” AI brain designed to operate any robot across tasks and raised the funding just seven months after a Series B at a $4.5 billion valuation

Etched.ai (AI Semiconductors): Etched.ai secured $500 million in new funding led by Stripes, valuing the Silicon Valley-based startup at $5 billion. The company is developing specialized chips aimed at powering AI superintelligence

Merge Labs (Brain-Computer Interfaces): San Francisco–based Merge Labs raised a $252 million seed round, reportedly with OpenAI as its largest backer. Founded by Sam Altman, the company is developing high-bandwidth brain–computer interfaces designed to integrate directly with advanced AI systems

Mirador Therapeutics (Biotech): Mirador Therapeutics closed a $250 million Series B to advance precision medicines for immune-mediated inflammatory and fibrotic diseases. Founded in March 2024, the San Diego-based startup has now raised more than $650 million in total funding

Onebrief (Defense Tech): Onebrief raised $200 million in Series D funding led by Battery Ventures and Sapphire Ventures and acquired Battle Road Digital. Based in Honolulu, the company builds AI-driven collaborative planning software used in military operations

Fintech Funding Jumped 27% In 2025 With Fewer Deals But Bigger Checks (Crunchbase, 4 minute read)

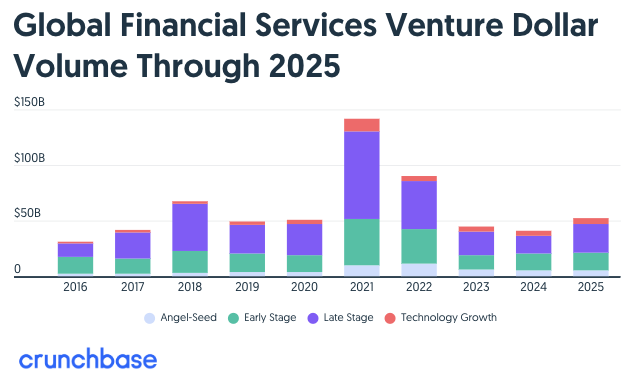

Global venture funding for fintech startups rose in 2025 to $51.8 billion, a 27% increase from $40.8 billion in 2024, marking the sector’s strongest year in several quarters. While funding remains well below the $141.6 billion peak in 2021 and $90.2 billion in 2022, it surpassed pre-pandemic levels from 2019 and 2020. The rebound was driven by fewer but much larger late-stage rounds, as deal count fell 23% year over year to 3,457

Several of the biggest raises went to crypto, blockchain, and prediction-market companies, reflecting a broader “flight to quality” as investors concentrate capital in more mature, high-traction fintechs

At the same time, early-stage activity remains strong in areas such as AI and stablecoins

LatAm Startup Funding Rebounds In 2025 As Mexico Sees Surge In Investment And VCs Remain Bullish On Region (Crunchbase, 5 minute read)

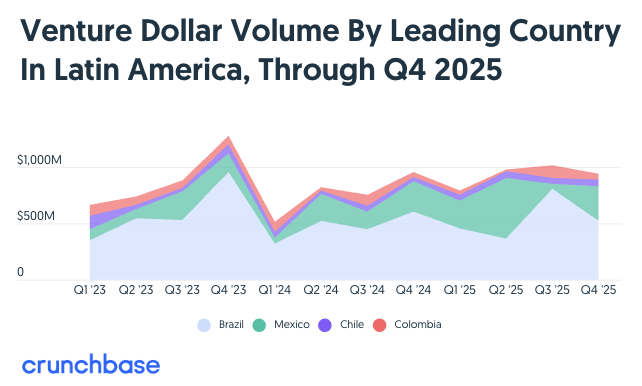

Startup investment in Latin America rose 14.3% in 2025 to $4.1 billion, up from $3.6 billion in 2024, driven by growth in both early- and late-stage funding. While activity remains well below the $8.4 billion invested in 2022 and far from the 2021 peak, investors are increasingly bullish on the region, particularly in fintech, as the middle class expands and digital adoption deepens. Brazil led the region with $2.1 billion raised, followed by Mexico at $1.1 billion

Early-stage funding was strong at nearly $2 billion for the year, while late-stage funding totaled $1.63 billion and fell sharply in Q4

Overall, investors say Latin America is reaching a structural inflection point

Regulatory progress, stronger fintech infrastructure, and underserved markets are creating long-term opportunities despite ongoing funding gaps

Wave of defections from former OpenAI CTO Mira Murati’s $12 billion startup Thinking Machines shows cutthroat struggle for AI talent (Fortune, 4 minute read)

Several senior researchers have left Mira Murati’s AI startup Thinking Machines Lab to rejoin OpenAI, underscoring how difficult it is for new “neo labs” to compete with established AI leaders. OpenAI confirmed that three core figures, cofounders Brett Zoph and Luke Metz, plus founding team member Sam Schoenholz, are returning, with reports that at least two more researchers also departed. This talent drain comes despite Thinking Machines raising a record $2 billion seed round in July at a ~$12 billion valuation, and reportedly exploring new funding at up to $50 billion

The exits underscore the structural disadvantages facing newer AI labs, as incumbents like OpenAI, Meta, and Google DeepMind can offer high six- to seven-figure compensation, faster liquidity via public stock or near-term IPOs, and privileged access to scarce AI compute

For early-stage challengers, competing increasingly requires not just technical differentiation, but alternative paths to talent retention, capital, and infrastructure

ECONOMIC SNAPSHOT

Trump administration wants tech companies to buy $15B of power plants they may not use (TechCrunch, 5 minute read)

The Trump administration is pressing PJM Interconnection, the largest U.S. electricity grid, to add about $15 billion in new generation through 15-year capacity contracts and wants tech companies to pay for it, even if they don’t need the power. The nonbinding proposal, backed by the White House and several governors, comes as data center electricity demand is expected to nearly triple over the next decade and regional power prices rose 10%–15% in 2025

PJM, which serves 65 million people across 13 states and includes Northern Virginia’s data center hub, has shown little enthusiasm and says it was not involved in shaping the plan

Higher natural gas prices, responsible for about 60% of recent increases, and the high cost and long timelines of building fossil fuel plants have made utilities cautious, especially if AI-driven demand fades

As a result, tech companies have leaned toward renewables like solar and batteries, which can be built in roughly 18 months and better match data center development timelines

US Economic Data Resilience Is Masking Underlying Stagflation (Bloomberg, 5 minute read)

President Donald Trump has touted an “economic boom,” pointing to strong headline data such as 4.3% annualized GDP growth in the third quarter, 4.9% productivity growth, and core inflation at 2.6%, a four-year low. Yet public sentiment tells a different story: consumer confidence has fallen for five straight months, only 24% of Americans say they are satisfied with the country’s direction, and 47% view economic conditions as poor. Beneath the surface, rising grocery and utility costs are straining household budgets, and job growth has been narrowly concentrated in health and education

The 584,000 net jobs added in 2025 mark one of the weakest annual gains in decades outside major recessions

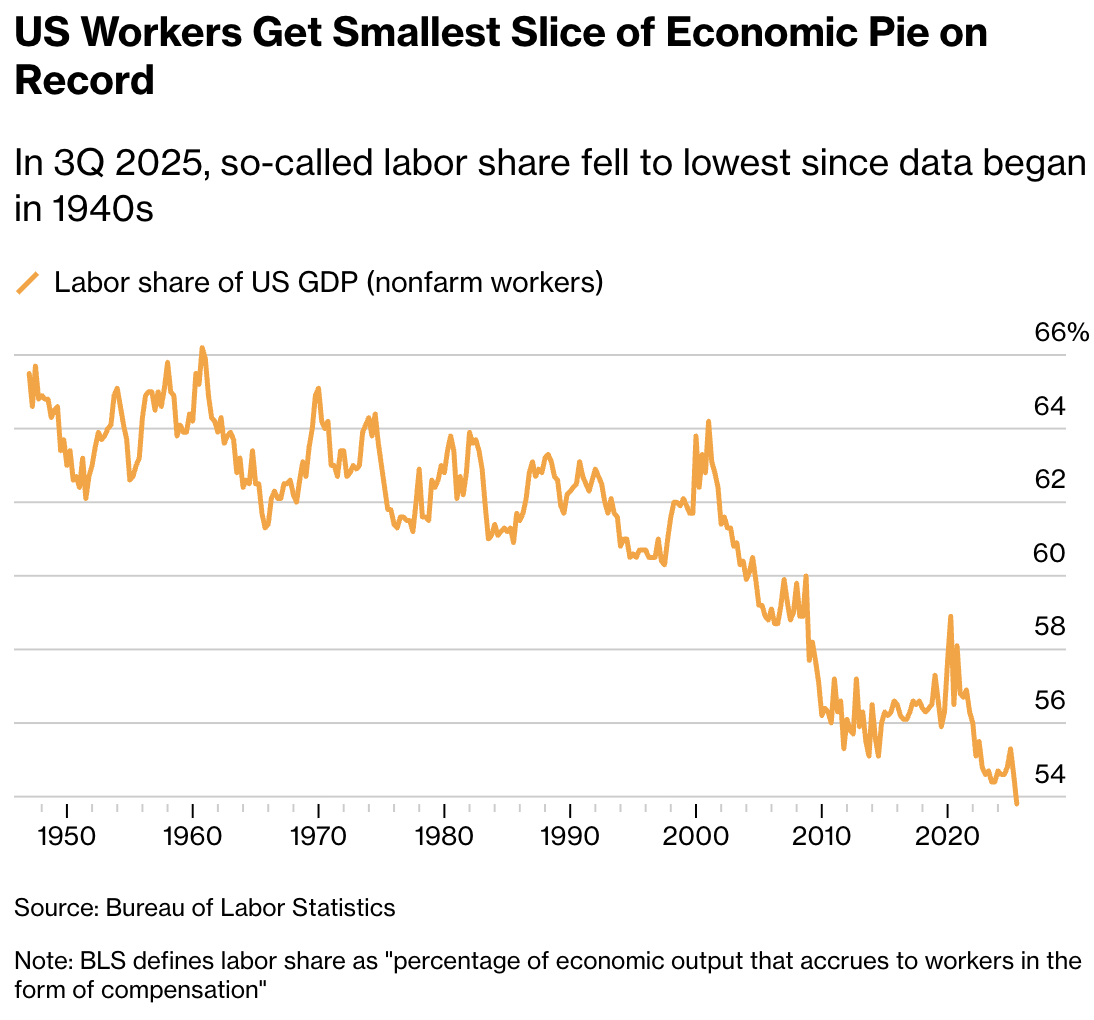

Incomes are rising faster than inflation, but workers’ share of the economy is at its lowest level since 1947, while corporate profits and asset prices mainly benefit wealthier households

Much of the growth is driven by AI investment, which has lifted GDP and markets but has not delivered broad gains, fueling public unease

Trump Said He’d Unleash the Economy in Year 1. Here’s How He Did (The New York Times)

One year after returning to office, President Trump has made mixed progress on his major economic campaign promises, even as the economy has shown resilience in some areas. Inflation has eased from its 2022 peak, but food prices have recently picked up again, with grocery costs posting their largest monthly increase since 2022, and electricity prices rising 6.7% year over year, while gas prices have fallen to about $2.78 per gallon, still above Trump’s sub-$2 pledge. Manufacturing outcomes have been weak: auto employment fell by about 28,000 jobs, manufacturing payrolls have declined for eight straight months, and factory investment has softened

By contrast, financial markets performed strongly, with the S&P 500 up 16% in 2025, largely driven by enthusiasm around artificial intelligence

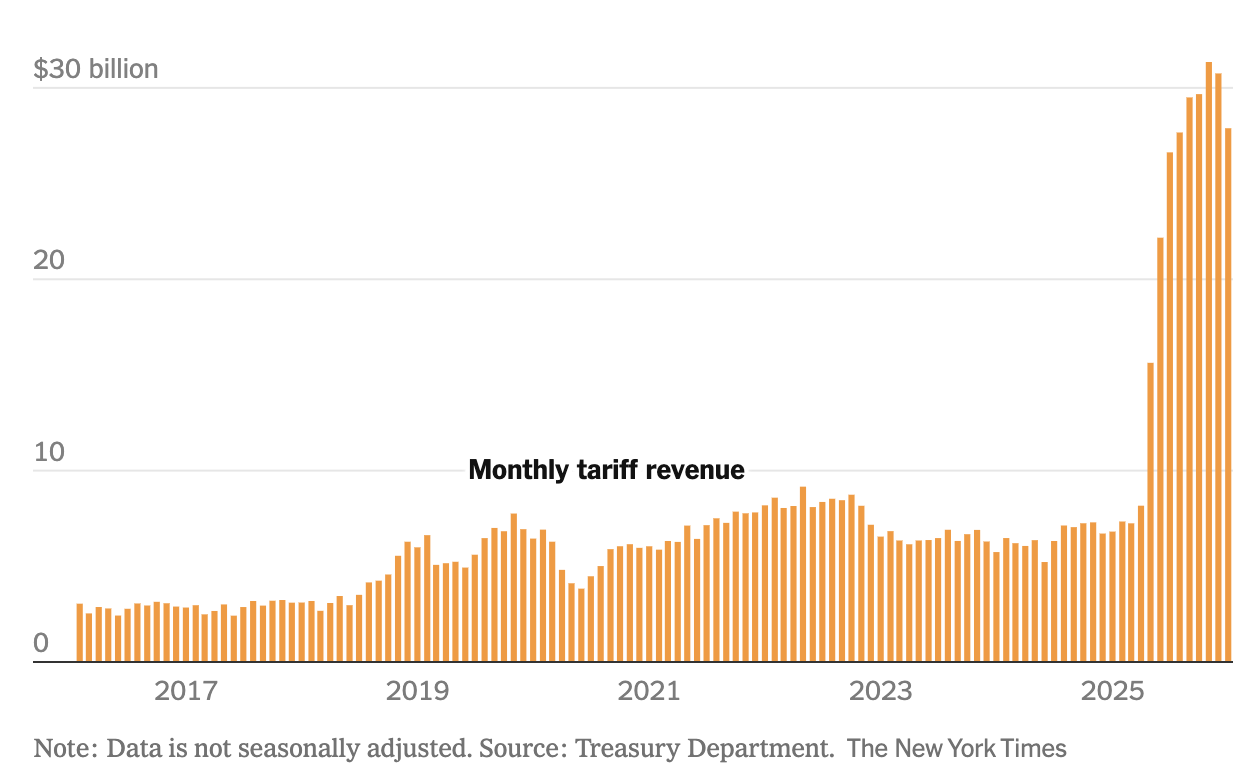

Tariffs generated record revenue of $264 billion in 2025, but are projected to add to deficits alongside tax cuts expected to increase debt by $3.4 trillion over 10 years

The trade deficit narrowed later in the year after an initial surge, though evidence of large-scale reshoring remains limited

Dow, S&P 500, Nasdaq futures skid after Trump threatens added European tariffs over Greenland (Yahoo Finance, 4 minute read)

Global markets fell after President Trump threatened to impose an additional 10% tariff on imports from eight European countries over their opposition to U.S. control of Greenland. U.S. stock futures dropped sharply, with the S&P 500 down 1.1%, the Nasdaq 100 down 1.5%, and the Dow futures down 0.8%, while major European indexes also declined, including France’s CAC 40 (–1.4%) and Germany’s DAX (–1.2%). European governments issued a joint statement warning the move could damage transatlantic relations and trigger a broader economic backlash

Asian markets were mixed, as China reported 5% growth in 2025, supported by exports despite slowing domestic demand

Investors are now focused on upcoming corporate earnings, new U.S. inflation data via the PCE index, and the Federal Reserve’s policy meeting in two weeks, where rates are expected to remain unchanged

Commodity prices were volatile, with oil slipping toward $59 a barrel, gold rising 1.8%, and silver jumping 5.5%

IPO & EXITS

2026 May Be the Year of the Mega IPO (New York Times, 8 minute read)

A wave of potential mega IPOs could mark a watershed moment for Silicon Valley and the A.I. boom, as OpenAI, Anthropic, and SpaceX take early steps toward going public. Any of the three would rank among the most valuable listings ever, with Anthropic in talks at a $350 billion valuation, OpenAI valued around $500 billion, and SpaceX at roughly $800 billion, second only to Saudi Aramco’s $1.7 trillion debut in 2019. After years of weak public offerings following the 2021 peak, these listings could reignite investor enthusiasm

They could also generate massive fees for Wall Street and offer rare transparency into A.I. economics amid bubble concerns

The move toward public markets reflects the enormous capital needs of A.I. companies. OpenAI has raised more than $60 billion and plans to spend $115 billion from 2025–2029

Some skeptics warn that heavy losses and constant fundraising could still dampen investor appetite, despite rapid revenue growth

IPO boom times are back, with SpaceX and OpenAI on investors’ 2026 wish list. But be careful what you buy (Fortune, 5 minute read)

The IPO market is heating up again after years of slowdown, with 2026 expected to bring far more listings than recent years. Potential debuts include giants like SpaceX and OpenAI, though activity will still be well below the 476 IPOs seen in 1999. IPO booms give investors more choice and the chance to buy future winners like Nvidia or BlackRock. But history shows they also produce many poor performers: the 1999 IPO class delivered –48% three-year returns, and the 311 companies that went public in 2021 posted –49% returns

Research suggests that IPO-heavy years often allow weaker or overvalued companies to list, raising the risk of losses

Experts advise patience, noting that sales, not profitability, are better indicators of long-term success

Waiting several months after an IPO, once insider lockups expire, can provide a clearer view of a company’s true value

Big Plan for Fannie and Freddie I.P.O. in Flux as Trump Pushes Affordability (The New York Times, 8 minute read)

Plans for a high-profile IPO of mortgage giants Fannie Mae and Freddie Mac have stalled, despite early momentum from President Trump, who last summer met with leaders of major banks to discuss taking the government-controlled firms public. Six months later, no lead Wall Street bank has been appointed, and a key question remains unresolved: whether the companies would be released from government control after any offering. Taken over during the 2008 financial crisis, Fannie Mae and Freddie Mac remain central to the $12 trillion U.S. mortgage market. Some officials worry that privatization could disrupt housing affordability, now a key priority ahead of the midterm elections

Recent moves, including an order for the firms to buy up to $200 billion in mortgage-backed bonds, suggest the White House may prefer to keep control

The goal is to influence mortgage rates, which are currently around 6.06% for a 30-year loan

Supporters say a partial sale could raise tens of billions of dollars for the Treasury and re-list the companies on major stock exchanges

But concerns about market stability, governance rules, and the firms’ role as quasi-public utilities have slowed the process

WHAT A TIME TO BE ALIVE

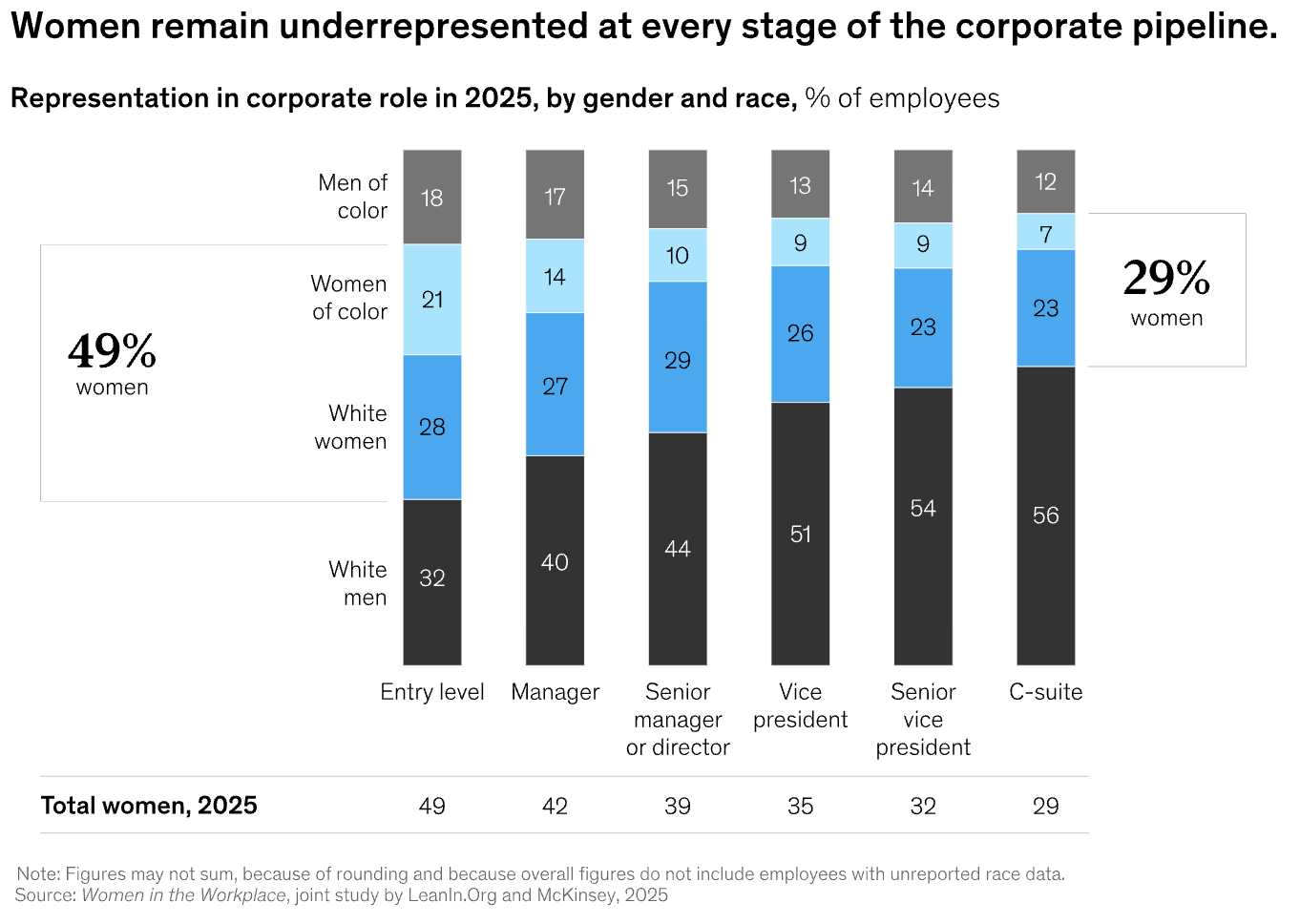

Women in the Workplace 2025 (McKinsey & Company, 8 minute read)

The Women in the Workplace 2025 report from McKinsey and LeanIn.Org shows that progress for women is slowing as fewer companies prioritize women’s career advancement. Only about 50% of companies now say supporting women’s advancement is a high priority. Women remain as committed to their careers as men, but a new ambition gap has emerged. Just 69% of entry-level women want a promotion, compared with 80% of men, while 84% of senior women want to advance versus 92% of senior men. Some companies are also scaling back programs that benefit women, including remote work, sponsorship, and targeted career development

Structural barriers persist. Women hold only 29% of C-suite roles, unchanged from 2024

At the critical first promotion, only 93 women are promoted to manager for every 100 men, dropping to 74 for women of color

Women receive less sponsorship and manager advocacy, especially early in their careers, despite sponsored employees being promoted at nearly 2x the rate of those without sponsors

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team