Wealth-Led Economy

Week of January 26th, 2026

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: A Big Week For AI And Drone Delivery (Crunchbase, 5 minute read)

Zipline (Drones): Drone delivery company Zipline raised over $600 million at a $7.6 billion valuation from investors including Fidelity, Baillie Gifford, Valor Equity Partners, and Tiger Global. The South San Francisco–based company plans to expand into at least four new U.S. states this year, starting with Houston and Phoenix

Humans& (AI): AI lab Humans& secured $480 million in seed funding after being founded in September by former researchers from Google, Anthropic, xAI, OpenAI, and Meta. The company is focused on developing AI systems centered around human relationships and interaction

Baseten (AI Infrastructure): San Francisco–based AI infrastructure startup Baseten raised $300 million, setting a $5 billion valuation, with backing from IVP, CapitalG, and Nvidia. The seven-year-old company provides tools for deploying and scaling AI models

OpenEvidence (Medical AI): Medical AI platform OpenEvidence raised $250 million in a Series D, doubling its valuation to $12 billion, in a round co-led by Thrive Capital and DST. The Miami-based company has completed four funding rounds in under a year

Noveon Magnetics (Advanced Manufacturing): Texas-based Noveon Magnetics raised $215 million in a Series C, including $200 million from One Investment Management, to expand its rare earth permanent magnet manufacturing capacity

Nvidia invests $2B to help debt-ridden CoreWeave add 5GW of AI compute (TechCrunch, 4 minute read)

Nvidia has invested $2 billion in CoreWeave, purchasing Class A shares at $87.20, to accelerate the data center company’s plan to add more than 5 gigawatts of AI computing capacity by 2030. The partnership includes jointly building “AI factories” powered by Nvidia’s full stack, from next-gen Rubin GPUs and Vera CPUs to Bluefield storage and AI software, while deepening CoreWeave’s integration with Nvidia’s reference architecture

The deal reinforces confidence in CoreWeave despite its heavy debt load ($18.8 billion as of September 2025) and follows its rapid expansion through acquisitions and major customers like OpenAI, Meta, and Microsoft

CoreWeave shares jumped over 15% on the news, marking another major bet by Nvidia to sustain momentum in the AI infrastructure boom

ECONOMIC SNAPSHOT

Is the US economy as hot as Donald Trump thinks? (Financial Times, 6 minute read)

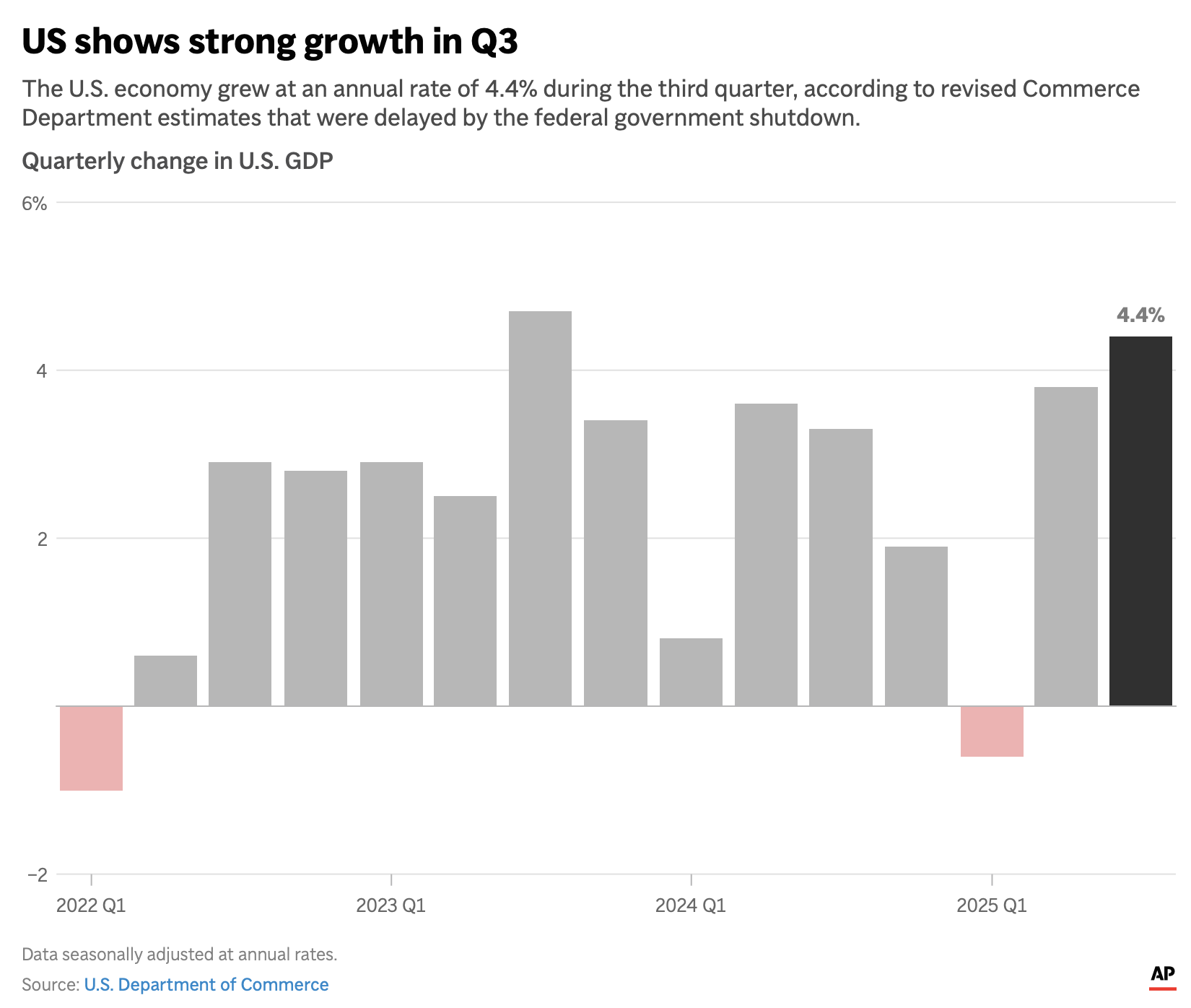

The U.S. economy is heading into 2026 with unexpectedly strong momentum, posting 4.4% annualized GDP growth in Q3 2025 and a projected 5.4% in Q4, levels that would mark the fastest expansion in over a decade outside the post-Covid rebound. Growth has been fueled largely by booming AI-driven investment and rising productivity, prompting optimism from the Trump administration and some economists, even amid trade policy volatility, clashes with the Federal Reserve, and a record-long government shutdown. However, many economists warn that the expansion is fragile, with risks including a resurgence of inflation from an intentionally “hot” economy and heavy reliance on AI returns that may not materialize

Additional concerns include elevated stock market valuations, with U.S. market capitalization at 226% of GDP, and large fiscal deficits approaching 6% of GDP

Institutions like the IMF have upgraded U.S. growth forecasts for 2026 to 2.4%

However, concerns remain that a pullback in AI investment or a tech market correction could meaningfully slow growth, and that many consumers are not yet feeling the benefits despite strong headline numbers

‘Some form of crisis is almost inevitable’: The $38 trillion national debt will soon be growing faster than the U.S. economy itself, watchdog warns (Fortune, 6 minute read)

U.S. national debt has reached 100% of GDP, putting the country on an unsustainable path that could trigger multiple types of fiscal crises, according to a new warning from the Committee for a Responsible Federal Budget (CRFB). The watchdog outlines six potential scenarios: financial, inflation, currency, default, austerity, or a slow “gradual” crisis; any of which could significantly disrupt markets and lower living standards if debt continues to grow faster than the economy

Rising interest costs (nearly $1 trillion last year, about 18% of federal revenue) are already straining public finances, reducing fiscal flexibility ahead of future shocks

While the timing of a crisis remains uncertain, the CRFB warns that without pro-growth deficit reduction, some form of fiscal reckoning is increasingly likely

This could range from abrupt, austerity-driven recessions to decades of slower growth as high debt crowds out investment

The rich are powering spending, with the U.S. economy in a danger zone (Axios, 3 minute read)

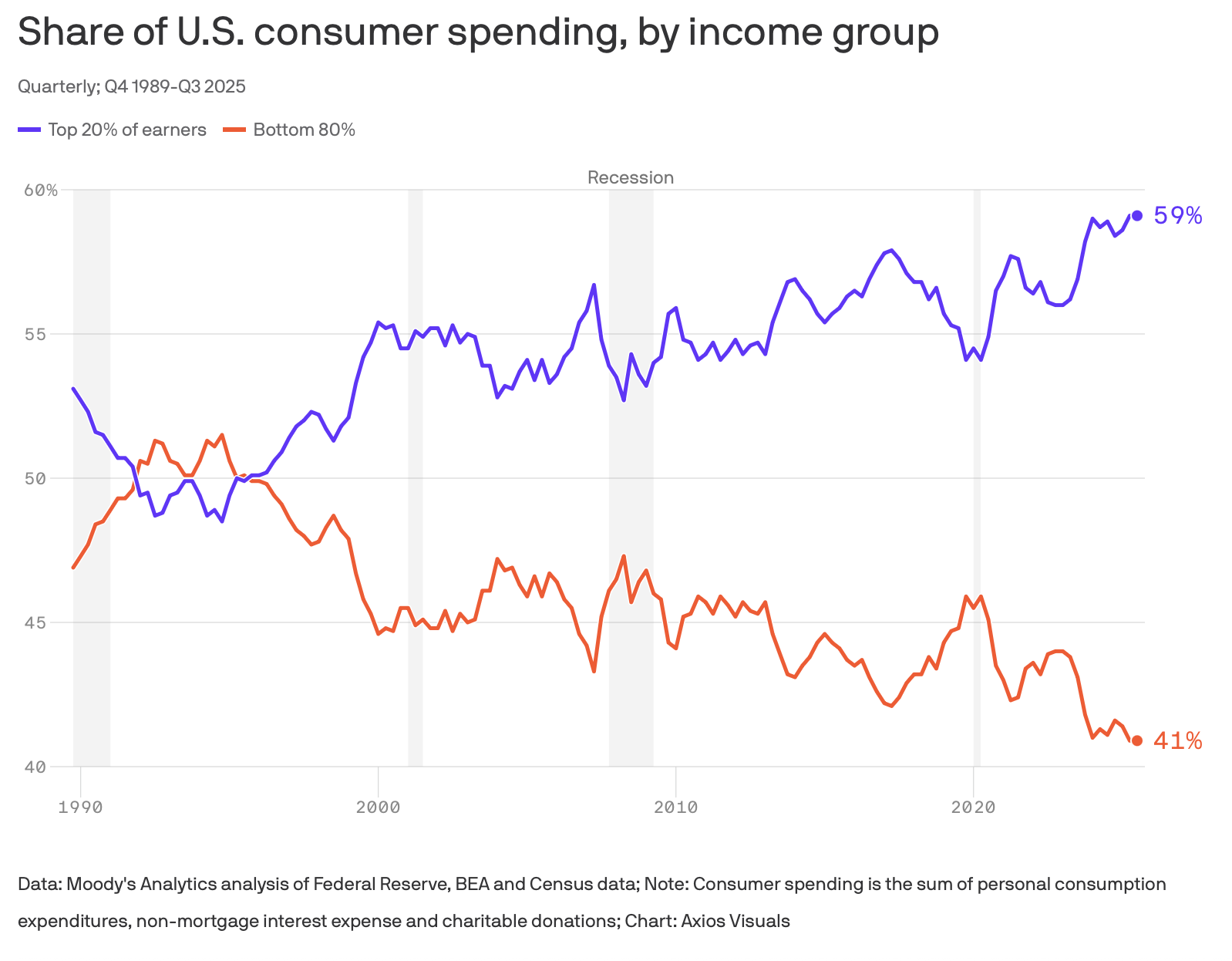

A growing share of the U.S. economy now depends on wealthy consumers, making growth increasingly fragile. According to Moody’s Analytics, the top 20% of income earners account for 59% of all consumer spending, a near record high, while the bottom 80% contribute just 41%, a record low. Inflation, weak job growth, and stagnant incomes have constrained spending for most Americans, even as stock market gains have boosted wealth at the top to its highest share since World War II

Economists warn that this “K-shaped” dynamic leaves the economy vulnerable: if markets fall and wealthy consumers pull back, a recession becomes far more likely, with the greatest harm falling on lower-income workers

This widening gap also helps explain declining consumer sentiment and rising social frustration across the country

Consumer spending pushes US economy up 4.4% in third quarter, fastest in two years (AP, 3 minute read)

The U.S. economy grew at a 4.4% annual rate in the third quarter, its fastest pace in two years, driven by strong consumer spending, rising exports, and increased business investment in AI. Consumer spending, which makes up about 70% of GDP, rose 3.5%, led by services like healthcare, while business investment increased 3.2% as companies continued to bet on AI

Despite this momentum, the job market remains weak, with employers adding just 28,000 jobs per month since March, compared with 400,000 per month during the post-pandemic boom

This divergence has produced a “jobless boom,” where economic growth is driven by wealthier consumers and technology investment

Meanwhile, many middle-class households continue to struggle with high living costs, stagnant wages, and declining economic confidence

IPO & EXITS

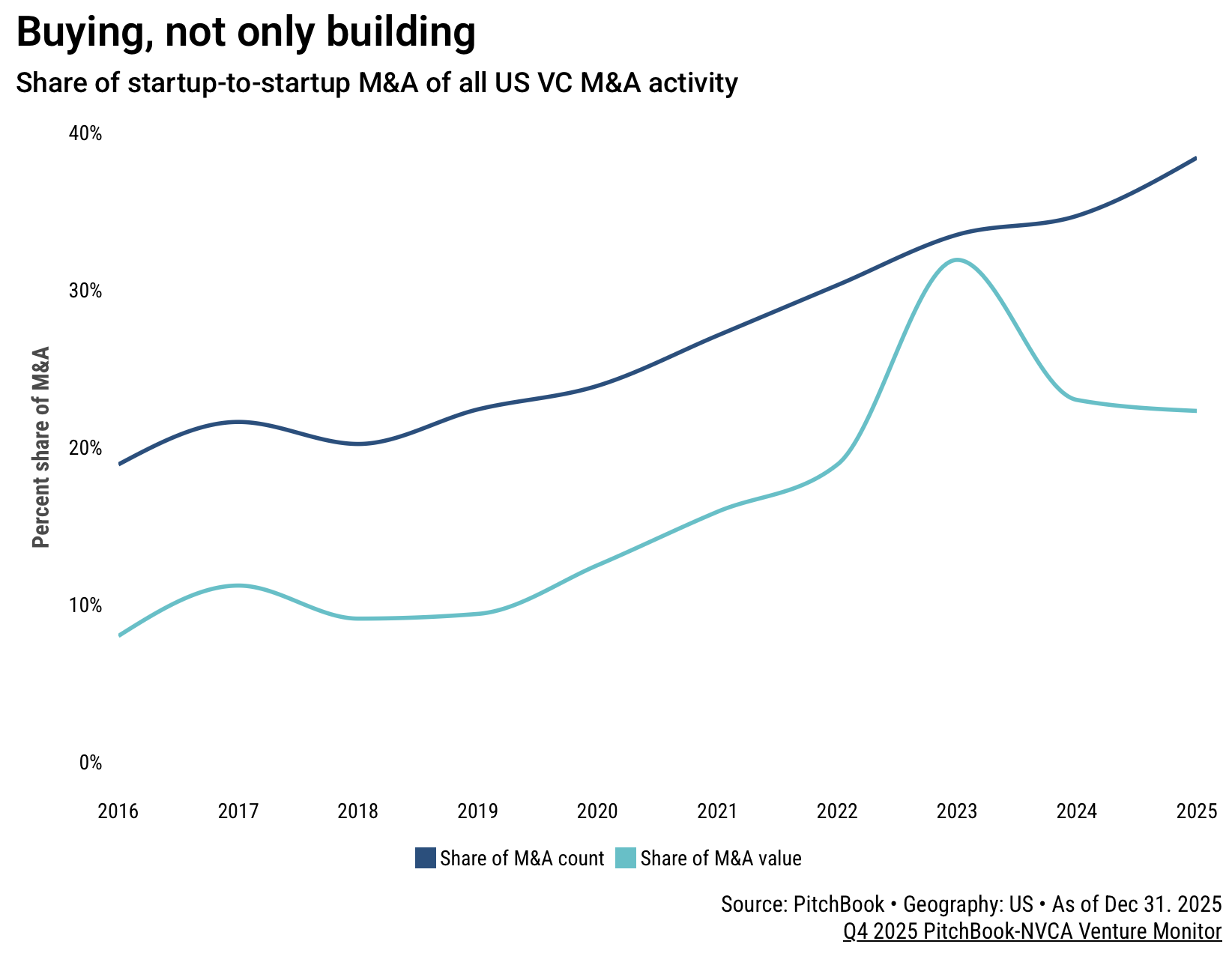

The startup-on-startup M&A spree is not slowing down (PitchBook, 4 minute read)

Startup-to-startup M&A hit record levels in 2025, accounting for 38.4% of all acquisitions of U.S. VC-backed companies, according to PitchBook-NVCA. Of 1,009 total M&A deals, 387 involved VC-backed buyers, representing $31.1 billion of the year’s $139.1 billion in deal value, the highest since 2021. The trend reflects fast-growing, well-capitalized startups, many in AI, using acquisitions to stay competitive, absorb talent, and extend product capabilities

As competition intensifies (often 25 competitors per category), acquisitions provide alternative paths to success for companies that may not scale independently

With the IPO bar rising sharply, from about $150M in revenue pre-2021 to $500M+ today, M&A is increasingly a strategic route to consolidation, IPO readiness, or an orderly exit

Capital One Strikes $5.15 Billion Deal for Fintech Brex (The Wall Street Journal, 5 minute read)

Capital One agreed to acquire fintech Brex for $5.15 billion in cash and stock, aiming to strengthen its corporate payments and expense management capabilities as competition from fintech and crypto firms intensifies. Founded in 2017, Brex provides corporate cards, expense tools, and oversees nearly $13 billion in deposits, serving clients like TikTok, Robinhood, and Intel. The deal follows Capital One’s strong Q4 results, with net income rising to $2.1 billion, though its shares fell nearly 5% after hours

Once valued at over $12 billion in 2022, Brex faced a tougher environment amid higher interest rates and slowing startup growth

The acquisition, expected to close in Q2, comes after Capital One’s $35 billion Discover Financial deal, further expanding its scale and reach in payments

The IPO Window Won’t Stay Open On Its Own (Crunchbase, 3 minute read)

The current IPO market resembles a window that opens briefly but risks slamming shut without warning. While the year began with optimism, many recent high-profile IPOs have underperformed: Figma has fallen from a $68B post-IPO peak to about $14B, while Circle is down over 66%, Klarna is near post-IPO lows, and Chime, StubHub, and Navan are all trading below their debut prices. This isn’t a collapse on the scale of the 2022 SPAC meltdown, and some names like CoreWeave have held up, but the broader performance weakens hopes for a strong IPO wave in 2026

This backdrop is especially challenging as several potential blockbuster IPOs loom, including SpaceX, reportedly targeting a $1.5T valuation, OpenAI at up to $1T, and Anthropic at around $350B

At the same time, a new wave of fintech companies such as Plaid, Ramp, Monzo, and Revolut are also preparing for possible public listings

While category-defining companies may still keep the IPO window open, more typical enterprise software unicorns are unlikely to generate the same demand and could be exposed if the window closes again

WHAT A TIME TO BE ALIVE

California’s New Diversity Reporting Law Imposes Obligations on a Wide Array of Asset Management Firms (JDSUPRA, 6 minute read)

California’s new Fair Investment Practices by Venture Capital Companies Act (FIPVCC) imposes significant new registration and reporting requirements on a broad range of investment firms with ties to California, extending well beyond traditional venture capital funds. Any firm that invests in operating companies with management rights, such as board or observer seats, and that either operates in California, invests in California-based companies, or solicits capital from California residents may be covered, even if headquartered elsewhere. Covered firms must register with the California Department of Financial Protection and Innovation (DFPI) by March 1, 2026

Beginning April 1, 2026, firms must annually report aggregated demographic data on the founding teams of their prior-year investments

Firms must use DFPI-approved surveys, keep participation voluntary, retain records for five years, and report investment counts, amounts, and company locations

The law includes strong enforcement provisions, with penalties of up to $5,000 per day per violation

Number of women-led VC firms grows, but fundraising is down (Venture Capital Journal, 5 minute read)

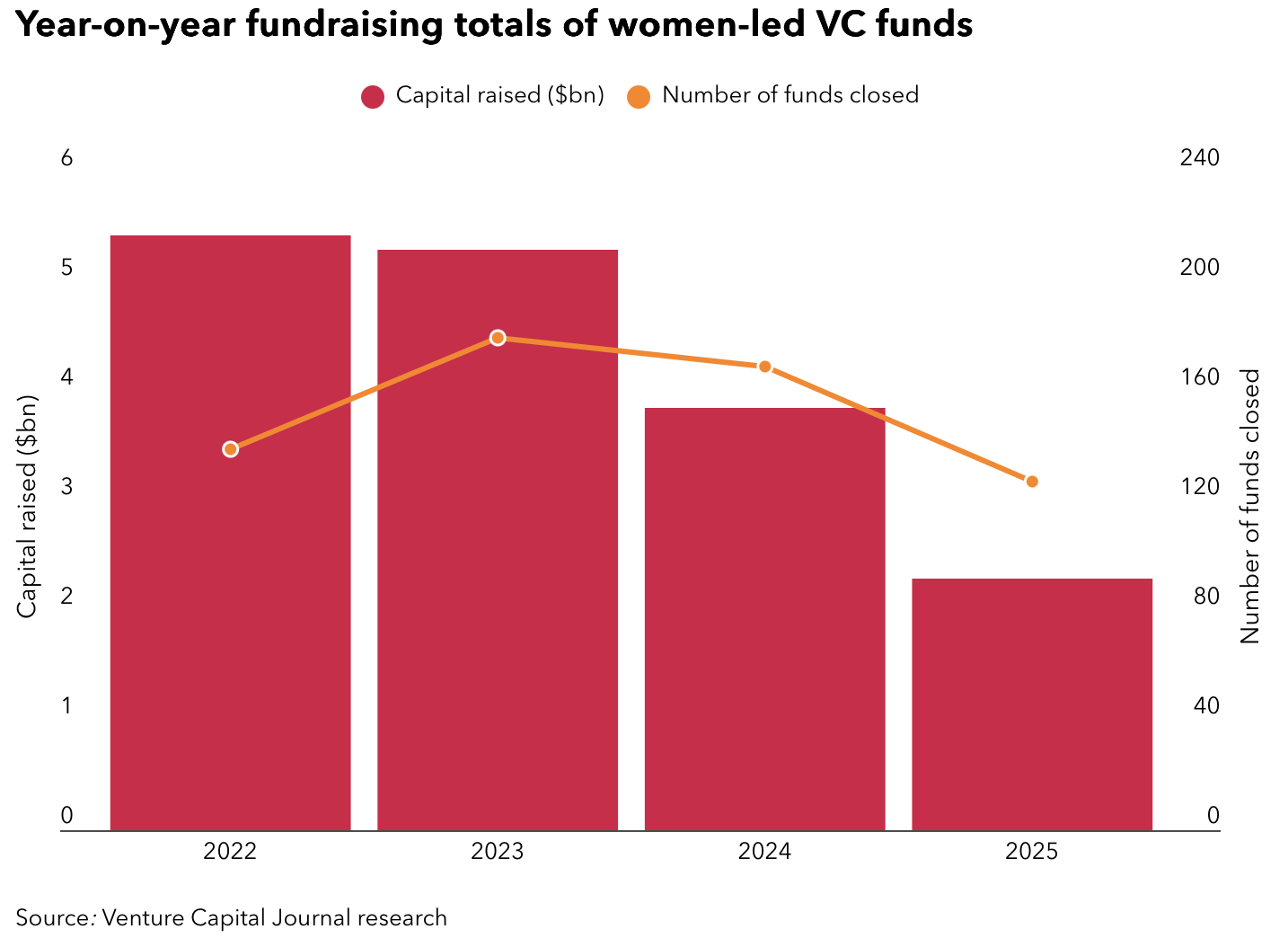

Global venture capital fundraising remained weak in 2025, with just $80.1 billion raised worldwide, a 38% year-over-year decline and less than half of the $208.7 billion raised in 2022, the industry’s peak. Women-led VC firms were particularly affected, raising $2.29 billion across 127 funds in 2025, down from $3.88 billion across 169 funds in 2024 and well below their $5.43 billion peak in 2022

While women-led funds’ share of total VC fundraising peaked at 3.7% in 2023, it fell to 3.01% in 2024 and declined again in 2025

However, their 2025 share of 2.85% still exceeded 2022 levels, offering a modest sign of progress despite the downturn

On a more positive note, the ecosystem continues to expand: the Directory of Women-Led VC Firms now includes 420 firms, with 32 new women-led funds added in the latest update

Venture Capital Is Rushing to Invest in Climate Tech, but on 1 Condition (Inc, 2 minute read)

Despite broader struggles in climate tech, AI-linked climate startups saw a breakout year in 2025. Venture investment in climate tech companies tied to AI reached a record $6.6 billion across 304 deals, a 59% increase year over year, even with 73 fewer deals than in 2024, according to PitchBook. Growth was driven by several megadeals, including Crusoe Energy’s $1.4 billion Series E, KoBold Metals’ $700+ million across two rounds, and Fermi’s $350 million Series C, reflecting strong investor demand for low-carbon infrastructure supporting AI, particularly data centers

More broadly, climate tech investment rose 8% to $40.5 billion in 2025, driven by fewer but larger deals

AI is increasingly enabling applications such as grid monitoring, energy management, weather forecasting, and geospatial analysis, even as federal support for clean energy has declined

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team