AI Economy

Week of January 5th, 2026

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

These Were The Largest Funding Rounds Of 2025 (Crunchbase, 4 minute read)

OpenAI (Artificial Intelligence): OpenAI raised $40 billion in a landmark financing led by SoftBank, the largest venture investment ever, valuing the company at roughly $500 billion. SoftBank is expected to fund $30 billion of the round (including $10 billion in debt) and syndicate the remaining $10 billion, with proceeds earmarked for expanding compute capacity, model training, and large-scale AI infrastructure amid surging enterprise and consumer demand

Scale AI (Generative AI Infrastructure): Scale AI raised $14.3 billion from Meta at a $29 billion valuation. As part of the deal, founder Alexandr Wang and select employees joined Meta to support its AI efforts, while Scale continues to serve a broad base of enterprise and government customers

Anthropic (Generative AI): Anthropic secured $13 billion in a Series F round at a $183 billion valuation, led by Iconiq Capital with Fidelity and Lightspeed Venture Partners as co-leads. The funding supports development of the Claude model family, expanded safety research, and rising infrastructure costs as the company competes with OpenAI and Google in large language models

Project Prometheus (Artificial Intelligence): Project Prometheus launched with $6.2 billion in initial funding to apply AI to physical and real-world tasks, positioning itself at the intersection of robotics, automation, and applied intelligence. The startup is reportedly co-led by Jeff Bezos and Vik Bajaj, and aims to translate advances in AI into scalable systems beyond purely digital applications

xAI (Generative AI): xAI, founded by Elon Musk, raised $5.3 billion in fresh equity funding, bringing total capital raised to over $22 billion across equity and debt in just over two years. The company is rapidly scaling its Grok models and compute footprint, leveraging close ties to X (formerly Twitter) as it competes aggressively in the frontier AI race

‘Hectocorns’ Are Just One AI Flashpoint for 2026 (Bloomberg, 4 minute read)

Artificial intelligence is entering a new phase, with investors now talking about “hectocorns”, AI startups valued at $100 billion+, and speculation growing that some could go public in 2026, reviving comparisons to the dot-com era. CoreWeave’s experience highlights the risks: its stock surged after its IPO but is now ~53% below its peak as investors scrutinize debt and execution. Much larger players like Anthropic and OpenAI, valued privately at roughly $300–350 billion and potentially $750 billion, respectively, may delay IPOs as long as private capital remains abundant, despite the strategic appeal of being first

At the same time, the AI buildout faces real-world constraints, as community resistance has led to $162 billion in US data-center projects being canceled or delayed since 2023, including $98 billion in Q2 2025 alone

These pushbacks are creating political and logistical hurdles that could slow the pace of AI expansion in 2026

2026: US Venture Capital Outlook (PitchBook, 30 minute read)

Optimism in the US venture market heading into 2026 is cautious but intact. Macroeconomic conditions look broadly stable, with GDP growth near 3.8%, inflation flat versus a year ago, expected rate cuts, and fewer policy surprises after nearly a full year of Trump administration implementation. While IPO growth is likely to be modest, liquidity should improve gradually through secondaries and selective exits, with early-stage deal activity continuing to rise. Liquidity remains the sector’s biggest challenge: despite a rebound in 2025, total exit value is expected to come in below $300 billion, even as VC net asset value has doubled since 2020 and LPs have faced $169 billion in negative net cash flows since 2022

Capital is increasingly concentrated among large, established funds, and nearly half of unicorns have been held for nine years or more, limiting traditional exit paths

AI is the dominant driver of venture activity. AI startups accounted for about 65% of US VC deal value, represent more than half of new unicorns, and collectively exceed $1 trillion in market value

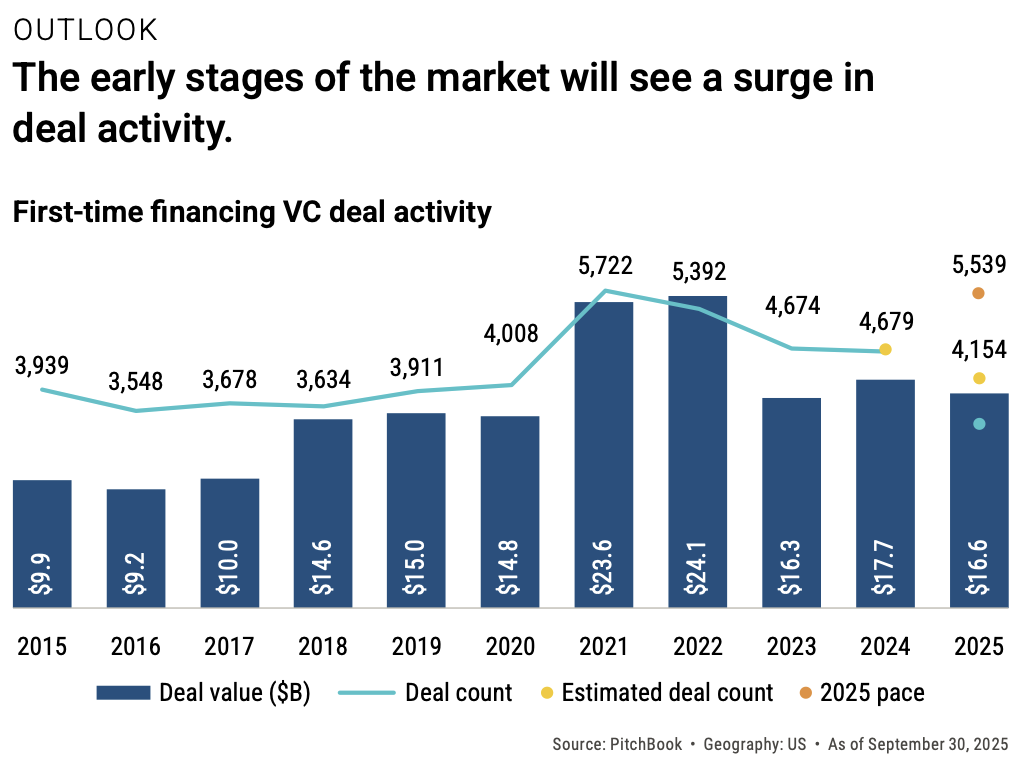

First-time financings in 2025 are close to the 2021 peak despite weak fundraising (only $45 billion raised through Q3), signaling a surprisingly strong early-stage market

ECONOMIC SNAPSHOT

The K-shaped economy reigned in 2025. It’s not going away in 2026 (CNN, 7 minute read)

Many U.S. households are heading into 2026 under rising financial strain despite strong headline growth. GDP expanded 4.3% in Q3, but inflation remains elevated and the labor market has softened, with slower hiring and easing wage growth. Household debt hit a record $18.59T, while stress indicators worsened: 12.41% of credit card balances turned seriously delinquent in Q3 (a 14-year high), consumer bankruptcies reached a five-year high, and student loan delinquencies remain near records, with up to 4M defaults possible in the next year

While higher-income households continue to support spending and markets, many lower- and middle-income families are cutting back

Potential relief in 2026 could come from Fed rate cuts, tax changes, price reductions, or tariff rollbacks, but uneven job and income growth remains a key risk

Trump’s Tax Stimulus Set to Keep US Economy on Track in 2026 (Bloomberg, 6 minute read)

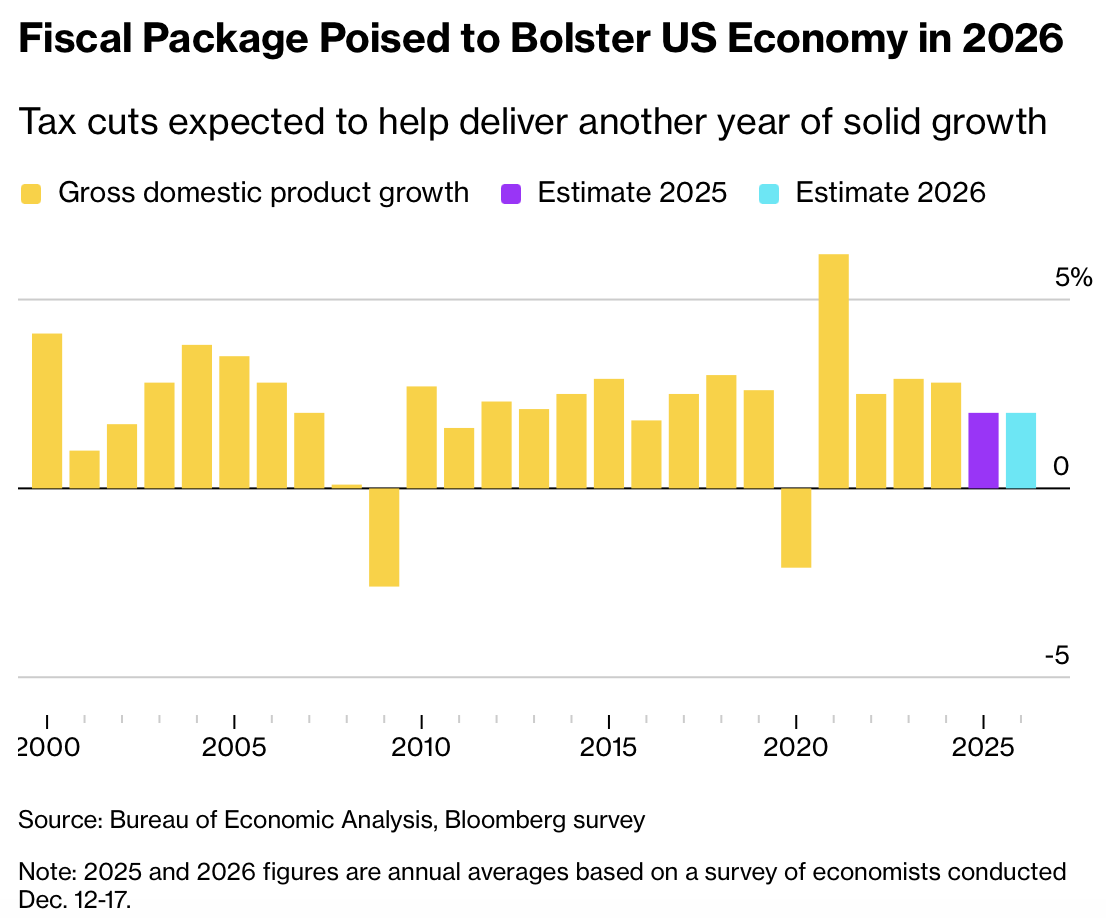

Economists expect the US economy to receive a short-term boost in 2026 from President Trump’s tax-cut package, with larger refunds adding an estimated $30–$100 billion to household income in the first half of the year and business incentives supporting investment. Average refunds are projected to be $300–$1,000 higher, and fiscal measures could lift GDP by about 0.3 percentage points, helping offset a cooling labor market as unemployment is forecast to average ~4.5%

Still, most forecasters expect US growth to settle around 2% in 2026, roughly in line with 2025 and below historical boom periods, according to surveys of economists, even as tax refunds and investment incentives provide a near-term lift

As the year progresses, fading fiscal stimulus, ongoing tariff costs for small businesses, rising affordability pressures, and uneven job creation from AI-driven investment are expected to weigh on momentum and limit upside

Overall, economists describe 2026 as a year of steady but modest expansion rather than a surge

Modest US Hiring to Cap a Sluggish Year for the Job Market (Bloomberg, 6 minute read)

U.S. job growth likely remained subdued in December, capping one of the weakest years for employment gains since 2009. Economists expect payrolls to have risen by about 60,000 jobs in December, bringing total job growth in 2025 to roughly 670,000, well below the 2 million jobs added in 2024. The unemployment rate is projected to have edged down slightly to 4.5%, after reaching a four-year high earlier in the fall

Hiring slowed as employers grew more cautious amid trade-policy uncertainty, cost pressures, and stabilizing job openings, while rapid AI adoption may also be dampening payroll growth by boosting productivity

Despite weaker hiring, layoffs remain limited, helping explain why the Federal Reserve, after three rate cuts at the end of 2025, is expected to proceed cautiously on further easing as it waits for clearer progress on inflation

US to extend productivity lead on back of AI boom, say economists (Financial Times, 5 minute read)

More than 75% of economists surveyed by the Financial Times expect the US to maintain or widen its global productivity lead, driven by advances in AI, deep and flexible capital markets, and lower energy costs. In the poll of 183 respondents, 31% said the US would retain its advantage and 48% said it would extend it. US labor productivity rose 10% from 2019 to 2024, reflecting stronger tech adoption and investment. Business investment in the US is 24% higher than pre-pandemic levels, versus a 7% decline in the Eurozone

Economists point to Europe’s rigid labor markets, fragmented infrastructure, and weaker innovation systems as constraints, while the US is expected to deliver the strongest G7 growth this year

While some warn AI investment could become bubble-like and that tariffs or immigration limits may weigh on growth, most expect US leadership in AI and scale advantages to persist, even as competition from Asia increases

Stocks, oil gain; investors downplay Venezuela events (Reuters, 4 minute read)

U.S. and global markets reacted to geopolitical developments involving Venezuela, with major stock indexes and oil prices moving higher. The Dow Jones Industrial Average rose about 1.2% to a record level, the S&P 500 gained 0.7%, and the Nasdaq advanced 0.9%, while European equities climbed roughly 0.9%. Energy stocks outperformed, with the S&P 500 energy sector up more than 2%, as oil prices increased on potential supply considerations: Brent crude rose to about $61.62 a barrel and U.S. WTI to $58.22

Gold also gained on modest safe-haven demand, rising 2.7% to around $4,447 an ounce, while the U.S. dollar eased slightly

Overall, investors appeared focused on upcoming U.S. economic data, including ISM manufacturing and the monthly jobs report, rather than materially repricing broader market risk

IPO & EXITS

US IPO Performance Lags S&P 500 in 2025 as Crypto, AI Deals Sink (Bloomberg, 3 minute read)

US IPOs delivered mixed results in 2025, as volatility and heightened scrutiny around AI and crypto pushed investors to favor fundamentals over hype. Newly listed companies gained 13.9% on a weighted average basis, lagging the S&P 500’s 16% return. Performance diverged sharply by size: IPOs raising $1 billion or more rose about 20%, while mid-sized deals ($500M–$1B) gained just 5.6%

Select AI names performed well: CoreWeave is up 98% since its $1.57 billion IPO

Others struggled: Fermi (down 58%) and Navan (down 35%)

Crypto listings were volatile: Circle remains up 169% despite fading from early highs, while Gemini is down 63%

The year’s largest IPO, Medline’s $7.2 billion debut, is up 40%, underscoring a market that is open but increasingly selective and driven by earnings, cash flow, and execution rather than momentum

AI Has Wall Street Watching for a SpaceX IPO (Barron’s, 5 minute read)

SpaceX is widely expected to pursue an IPO in 2026 that could raise up to $30 billion, potentially making it the largest public offering in history and surpassing Saudi Aramco’s $29 billion IPO in 2019. The company conducted 160+ Falcon 9 launches in 2025, accounting for more than half of all orbital launches, and its Starlink business now has over 8 million customers and is profitable

Interest in a SpaceX IPO is rising as the company explores AI uses such as space-based, solar-powered data centers with cooling and connectivity advantages

Analysts say AI demand could strengthen SpaceX’s launch dominance, with valuations varying widely; ARK Invest estimates it could be worth $2.5 trillion by 2030

MiniMax Is Said to Plan Pricing Hong Kong IPO at Top on AI Fervor (Bloomberg, 3 minute read)

MiniMax is set to price its Hong Kong IPO at the top of its range, reflecting strong investor demand for Chinese generative AI startups challenging US peers like OpenAI. The Alibaba- and Abu Dhabi–backed company plans to sell shares at HK$165, raising at least HK$4.2 billion ($538 million), after orders came in several times oversubscribed

As one of the first post-ChatGPT Chinese AI firms to go public, MiniMax’s debut, alongside rival Zhipu, underscores Beijing’s support for domestic AI champions

It also signals a busy pipeline of AI-driven IPOs in Hong Kong, with up to $4.1 billion in listings planned this month

WHAT A TIME TO BE ALIVE

As Childcare Costs Surpass Inflation, More Women Leave the Labor Market (Investopedia, 3 minute read)

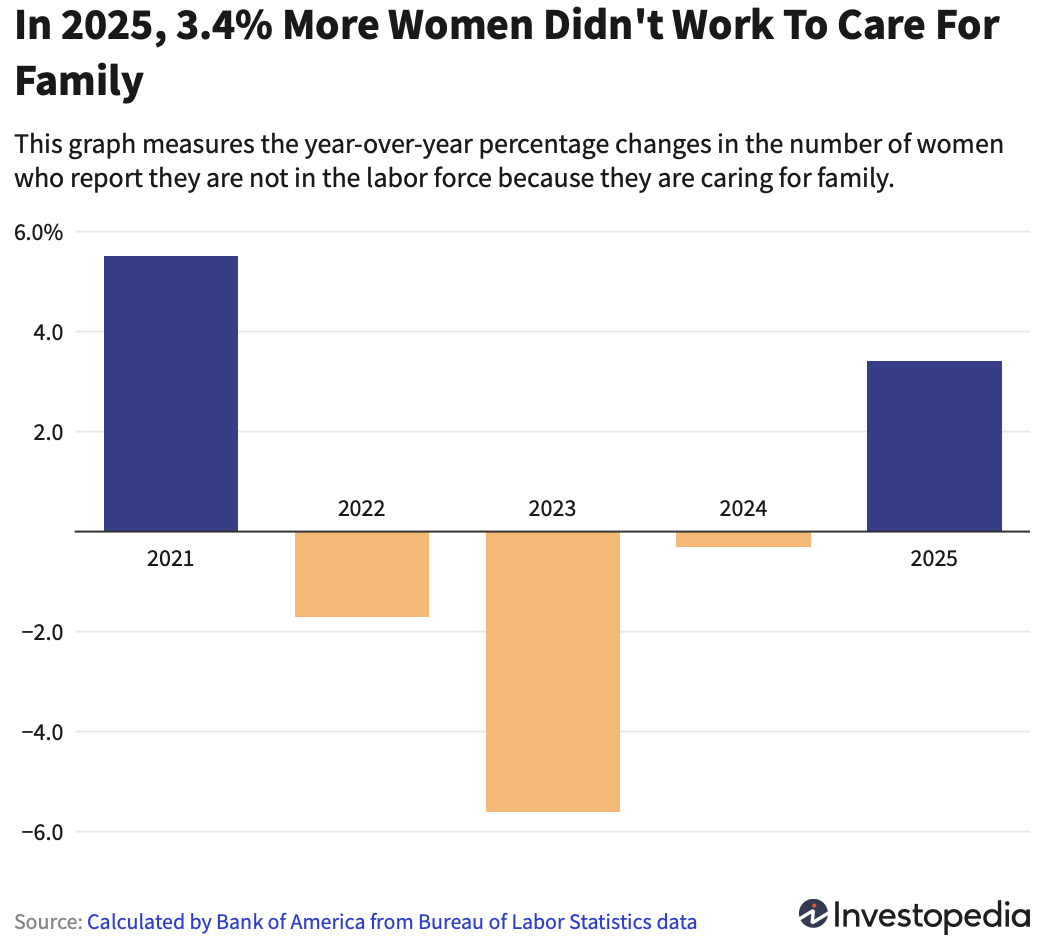

Childcare costs are rising far faster than overall inflation, contributing to a growing number of parents, especially mothers, leaving the labor force. Daycare prices increased 5.2% year over year in September 2025, about 1.5× the overall inflation rate of 3%, according to Bank of America and the BLS. For some families, the cost of care for one child now exceeds a month’s rent and is nearly $1,800 higher than average annual tuition at a public four-year college

In 2025, the share of women citing family responsibilities as the reason for not participating in the labor force rose for the first time since 2021, while men’s participation continued to increase

From 2022–2024, about 70% of mothers with children under six who were not working said they couldn’t do so because they lacked childcare or had family obligations

The trend is reducing dual-income households, creating labor gaps, and raising concerns about long-term workforce participation and economic growth

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team