A Richer Christmas?

Week of December 8th, 2025

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: Investors Get Back To Writing Large Checks (Crunchbase, 5 min read)

Kalshi (Predictions Market): Predictions marketplace Kalshi confirmed a $1 billion funding round led by Paradigm, with participation from a broad group of venture investors

Castelion (Defense Tech): Hypersonic munitions developer Castelion raised $350 million in a Series B round led by Altimeter Capital and Lightspeed Venture Partners. The company was founded in 2022 by a former SpaceX engineer

Eon (Cloud Data): Enterprise AI data-backup provider Eon secured $300 million in a Series D led by Elad Gil of Gil Capital, bringing total funding to $500 million and valuing the New York-based company at $4 billion

Curative (Health Insurance): Austin-based Curative, which offers a no–out-of-pocket-cost health plan, raised $150 million in a Series B round led by Upside Vision Fund, reaching a $1.27 billion valuation

Angle Health (Health Insurance / AI Benefits): Angle Health closed $134 million in a Series B round led by Portage Ventures, structured as a mix of debt and equity, bringing total funding to nearly $200 million

Startup Funding Continued On A Tear In November As Megarounds Hit 3-Year High (Crunchbase, 3 min read)

Global venture funding reached $39.6 billion in November, matching October’s total and rising 28% year over year from $31 billion. Capital grew increasingly concentrated, with 43% of all funding going to just 14 companies, each raising $500 million+, marking the highest number of megarounds in three years. The largest round went to Jeff Bezos’ Project Prometheus, which secured $6.2 billion. Other billion-dollar deals included Anysphere ($2.3B), AI data center provider Lambda ($1.5B), and Kalshi ($1B)

The U.S. remained dominant, capturing over 70% of global venture funding, followed by China ($2.4B) and then the U.K. and Canada, each raising $1B+

AI startups led the month, accounting for 53% of global venture funding (over $20B), with significant activity also in hardware and fintech

November confirmed the big trends of 2025: AI dominated funding, deep tech and hardware stayed strong, and the U.S. led venture investment

At least 80 new tech unicorns were minted in 2025 so far (TechCrunch, 6 minute read)

AI’s explosive growth has fueled a surge in new unicorns throughout the year, with startups across generative AI, AI infrastructure, agent platforms, and AI-enabled enterprise software dominating the list. The majority of new $1B+ companies in 2025 are AI-related, though notable exceptions emerged in space, biotech, fintech, and blockchain sectors, including satellite maker Loft Orbital and prediction market Kalshi

Across the year, startups reached unicorn status with valuations ranging from $1 billion to as high as $10 across AI agents, cloud computing, biotech, medtech, quantum, dev tools, robotics, and crypto trading

Many of these unicorns raised large rounds, including numerous $100M+, $250M+, and even $500M+ financings, often within a few years of launching

2025 is minting unicorns at a rapid pace, led by AI but spreading across deep tech, healthcare, fintech, and space, showing investors’ growing appetite for frontier technologies and next-gen infrastructure

ECONOMIC SNAPSHOT

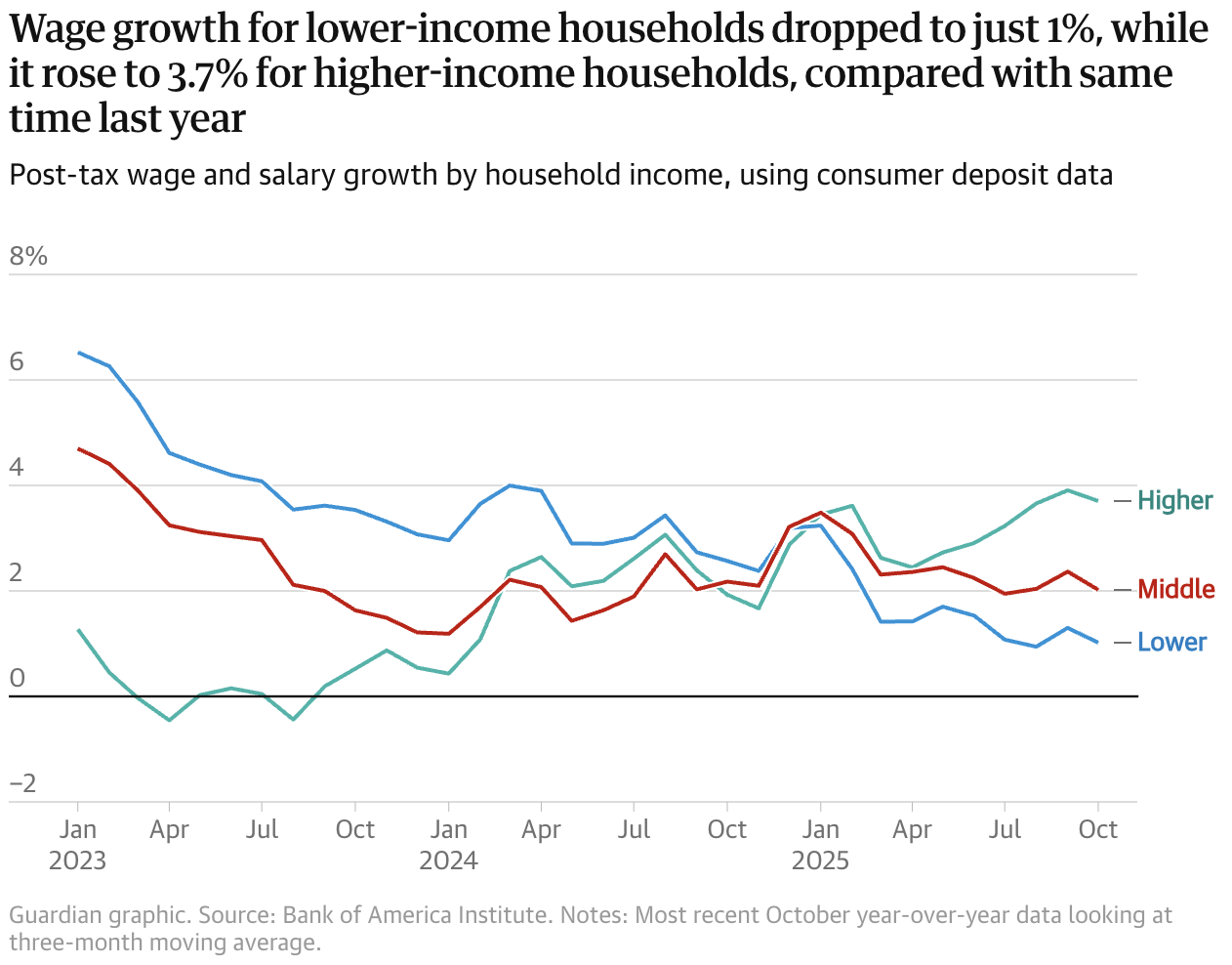

The K-shaped Christmas: wealthy few drive holiday spending splurge while many struggle to get by (The Guardian, 5 minute read)

A new Printemps luxury store in downtown NYC highlights the widening K-shaped economy: while shoppers sip champagne and browse $600 coats and $1,450 boots, hundreds line up for free food across the street. The contrast mirrors national trends driven by surging asset wealth among the top 1%, who now own nearly 50% of the stock market, even as most Americans struggle with rising costs. The S&P 500 has climbed 86% in five years, fueled by the AI boom, but inflation has risen from 2.3% to 3% since April and unemployment from 4% to 4.4%

Trump’s tariffs are expected to add 1.2% to prices, costing the average household $1,700, contributing to his drop from +5% to –35% net approval on inflation

Poverty is rising as safety-net programs shrink: NYC’s poverty rate is now 25% vs. 13% nationally, and low-income spending grew just 0.7% compared to 2.7% for high earners

CEOs at Delta, Coca-Cola, and McDonald’s all report sharply diverging consumer behavior, underscoring an economy where luxury demand booms, budget shoppers pull back, and “rich people are still rich”

China’s trade surplus tops record US$1 trillion, defying trade war uncertainty (SCMP, 3 minute read)

China’s trade surplus hit a historic US$1.076 trillion in the first 11 months of 2025, already surpassing last year’s full-year record of US$992.2 billion, as Beijing aggressively diversified export markets amid Trump-era tariff uncertainty. Exports rebounded 5.9% YoY in November to US$330.35B, beating forecasts, while imports grew a weaker 1.9% YoY, underscoring sluggish domestic demand and producing a US$111.68B monthly surplus. Analysts say strong exports should help China hit about 5% GDP growth in 2025, but weak imports show China still struggles to build stronger domestic demand

Shipments to the U.S. continued to plunge (–28.6% YoY), while exports to the EU, Japan, South Korea, and Africa grew 14.8%, 4.3%, 1.9%, and 27.6%, respectively

Rare-earth exports jumped 26.5% MoM, and tensions with Washington eased slightly after tariff reductions, renewed soybean purchase commitments, and progress in tech-export disputes

Divided Fed ponders US interest-rate cut at end of tumultuous year (The Guardian, 3 minute read)

The Federal Reserve heads into its final meeting of the year divided over whether to deliver a third rate cut, as officials grapple with limited economic data after a six-week government shutdown and rising tensions inside the committee. Rates currently sit at 3.75%–4%, but while some members want further easing following the September and October cuts, others warn that persistent 3% inflation and a rising 4.4% unemployment rate demand caution

With October data missing and November figures delayed, Chair Jerome Powell has warned the Fed must “slow down” as it navigates a rare moment in which both inflation and joblessness are increasing

Political pressure is also mounting, as Donald Trump reportedly considers Kevin Hassett, a strong advocate for more cuts, as Powell’s potential successor when his term ends in May

The 12-member FOMC will announce its decision Wednesday amid unusually high uncertainty and internal disagreement

Bessent says U.S. will finish the year with 3% GDP growth, sees ‘very strong’ holiday season (CNBC, 3 minute read)

Treasury Secretary Scott Bessent said the U.S. is on track to end 2025 with around 3% GDP growth, calling the holiday shopping season “very strong” despite the government shutdown. After GDP contracted 0.6% in Q1, it rebounded to +3.8% in Q2, and the Atlanta Fed estimates 3.5% growth for Q3. But consumers remain pessimistic: the University of Michigan sentiment index rose to 53.3, still 28% below last year, while inflation, delayed by the shutdown, showed 3% annual price growth in September, including 3.1% food inflation

Trump continues to dismiss affordability concerns as a “scam,” even as polls show roughly two-thirds of voters disapprove of his handling of the economy

Bessent blamed lingering “scarcity” from the Biden administration and argued Americans “don’t know how good they have it,” predicting a shift to “prosperity” next year

IPO & EXITS

Secondary buyers turn to middle-market continuation funds (PitchBook, 4 minute read)

Secondary investors are increasingly shifting from large continuation vehicles to middle-market deals, according to a Lazard survey of 68 secondary firms. Nearly 47% of respondents said they plan to focus on middle-market continuation funds in 2025, and over 60% expect to allocate at least 60% of their dry powder to these deals. The pivot reflects both opportunity and saturation: while 67% of large-cap GPs have already executed GP-led secondaries, only 31% of mid-cap GPs have done so, leaving significant untapped supply

Middle-market deals also allow secondary buyers to take larger, often sole lead positions without syndicates, and offer more exit options compared to large-cap assets that depend heavily on public markets or major strategics

This trend has been building since 2021, and middle-market PE-backed assets now make up the majority of the $47 billion continuation vehicle market

It has helped drive record secondary activity, with $103 billion in transaction volume in the first half of 2025, on pace to surpass last year’s $162 billion total

Anthropic reportedly preparing for one of the largest IPOs ever in race with OpenAI: FT (CNBC, 3 minute read)

Anthropic, maker of the Claude AI chatbot, is reportedly in early discussions to launch one of the largest IPOs as soon as next year, according to the Financial Times. The company has engaged Wilson Sonsini, known for taking Google, LinkedIn, and Lyft public, and is simultaneously pursuing a private funding round that could value it at over $300 billion, including a $15 billion combined commitment from Microsoft and Nvidia. Recent reports suggest Anthropic’s valuation may already be approaching $350 billion, following up to $5 billion from Microsoft and $10 billion from Nvidia

While IPO talks with banks remain preliminary, Anthropic is said to be preparing internally, boosted by recent hires such as former Airbnb executive Krishna Rao, who helped lead Airbnb’s 2020 IPO

The company is also scaling rapidly, announcing a $50 billion AI infrastructure expansion and tripling its international workforce

A public listing would set up a potential race with rival OpenAI, which has been valued at $500 billion after a $6.6 billion share sale but has said it is not pursuing a near-term IPO

WHAT A TIME TO BE ALIVE

US VC female founders dashboard (PitchBook, 4 min read)

Venture capital funding for female-founded startups in the U.S. has stabilized after a steep decline from the 2021 peak. While women-led companies now represent a smaller share of total VC deals, they continue to capture a growing portion of total capital raised, signaling stronger deal quality and investor confidence. So far, Q4 2025, women co-led companies secured $22.1 billion across 487 deals

So far in 2025, female-only founded companies have captured 6.0% of total deal count, while female-and-male co-led teams account for 17.8%

In terms of capital, female-only teams received 1.2% of total VC investment, compared to 39.6% going to mixed-gender founding teams

According to PitchBook data, the 16-year trend shows steady progress across states, industries, and stages, highlighting a sustained shift toward greater inclusion and visibility for women founders in the U.S. venture ecosystem

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team