December Rate Cut?

Week of December 1st, 2025

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: A Lot Of Really Big Deals (Crunchbase, 5 min read)

Lambda (AI cloud infrastructure): San Francisco–based Lambda, a provider of AI cloud infrastructure, raised over $1.5 billion in Series E funding led by TWG Global. Founded in 2012, the company has now raised $3.2 billion in equity and debt

Kalshi (Predictions market): New York–based Kalshi, a marketplace for trading on future events, raised $1 billion in a new round led by Sequoia Capital and CapitalG, valuing the 7-year-old company at $11 billion

Luma AI (Multimedia AI): Silicon Valley–based Luma AI, which builds AI-generated video and imaging tools, secured $900 million in a Series C round led by Humain, with significant participation from AMD

Kraken (Cryptocurrency): Crypto exchange Kraken raised $800 million across two tranches from investors including Jane Street, DRW Venture Capital, HSG, Oppenheimer, and Tribe Capital. Citadel Securities also made a $200 million strategic investment at a $20 billion valuation

Physical Intelligence (Robotics AI): San Francisco–based Physical Intelligence, which develops AI software for robotics, raised $600 million in a round led by CapitalG, reportedly valuing the company at $5.6 billion. Backers included Lux Capital, Thrive Capital, Jeff Bezos, Index Ventures, and T. Rowe Price

Long Live The AI Tech Bubble (Crunchbase, 4 min read)

Nearly half of all global startup funding in 2025 has flowed into AI companies, about $40 billion of the $91 billion raised in Q2, and by Q3 nearly 50% of all startup capital went to AI, with one company capturing a third of global funding. While some see this concentration as a warning sign, analysts argue it reflects the early stages of a generational technology shift, similar to how investment around Netscape in the 1990s unlocked decades of internet innovation. Mega-rounds for OpenAI, Scale AI, and others are building the AI infrastructure powering a new wave of startups in legal tech, robotics, and drug discovery

Many of these companies are showing strong fundamentals, with enterprise AI firms reaching $20 million in annual revenue in ~2 years (versus ~7 years for SaaS), growing 200%+ annually, and delivering measurable ROI

While valuations are elevated, the wave is driven by real economic impact rather than debt-fueled speculation

With tech already 45% of the S&P 500 and projected to reach 28%–50% of global GDP, investors with strong tech exposure are positioned to benefit as AI accelerates productivity and reshapes industries

AI startup valuations are doubling and tripling within months as back-to-back funding rounds fuel a stunning growth spurt (Fortune, 4 min read)

A handful of top AI startups are raising multiple massive funding rounds in the same year, sending their valuations skyrocketing at unprecedented speed. Anthropic jumped from $61.5B to $183B in six months, OpenAI surged from $157B to $500B in one year, adding ~$29B per month, or nearly $1B per day. Mid-tier startups are showing similar patterns: Mercor jumped from $2B to $10B within months, while companies like Cursor, Harvey, and others have raised two or more rounds in 2025 with valuations increasing by billions each time

Unlike the 2021 ZIRP-era froth, investors argue this surge is backed by exceptional revenue momentum

Investors say the “prize is so big” in AI that startups are strategically raising aggressively to lock up capital, outpace competitors, and attract top-tier funds before rivals can

But the speed comes with risks: inflated valuations, cap table dilution, unstable burn rates, and potential crashes if companies can’t sustain growth, mirroring past comedowns like the 2021 cohort

The race to regulate AI has sparked a federal vs state showdown (TechCrunch, 5 min read)

Washington is nearing its first major decision on how to regulate artificial intelligence, but the core battle is not over AI itself, it’s over who gets to regulate it. With no federal AI safety standard in place, 38 states have passed more than 100 AI-related laws, prompting the tech industry and several White House officials to push for federal preemption that would block state rules. House lawmakers have explored adding such a provision to the National Defense Authorization Act, and a leaked draft executive order shows the administration considering an “AI Litigation Task Force” to challenge state laws

Critics in Congress argue that banning state regulation without a federal standard would leave consumers unprotected

Meanwhile, Rep. Ted Lieu and the bipartisan House AI Task Force are preparing a 200+ page federal AI “megabill” covering fraud, deepfakes, transparency, and safety testing, though it could take years to pass

The conflict pits tech companies and pro-AI PACs advocating for national rules (or minimal regulation) against lawmakers and state officials who say states must act quickly to address emerging AI risks while Congress lags behind

ECONOMIC SNAPSHOT

K-shaped economy and inflation boost Black Friday sales by 4.1% from last year, online spending jumps 9.1% (CNN, 4 min read)

U.S. Black Friday sales rose 4.1% year-over-year, Mastercard SpendingPulse reported, while online spending hit a record $11.8 billion, up 9.1% from 2024 according to Adobe, though inflation means real spending was likely close to flat. Economists say the season reflects a K-shaped economy: higher-income shoppers continue to spend freely on luxury goods and travel, while low- and middle-income consumers are cutting back, budgeting carefully, and hunting for discounts

The National Retail Federation found 85% of shoppers expect higher prices due to Trump’s tariffs, adding to cost-of-living concerns amid slowed job growth and temporary disruptions like the federal shutdown’s pause in SNAP funding

Holiday spending is still expected to grow 3.7%–4.2%, with the NRF forecasting a record $1 trillion in total seasonal sales

Online demand has been boosted by heavy discounting, early shopping, and continued growth in “buy now, pay later,” which Adobe expects to hit $20.2 billion this season

‘Weaker job growth and lower inflation’: It’s all lining up perfectly for a Fed cut in December (Fortune, 4 minute read)

U.S. markets were closed for Thanksgiving, but S&P 500 futures held steady after the index logged its fourth straight gain, ending just 1% below its all-time high. Global markets were similarly calm, with India’s Nifty 50 hitting a record high. Investor optimism is rising as macro data increasingly points toward a Federal Reserve rate cut at the December 9–10 meeting, with the CME FedWatch tool pricing an 85% probability of a cut to 3.5%. Goldman Sachs summed up the momentum as “weaker job growth and lower inflation,” a mix that typically pushes the Fed toward easing, and UBS expects multiple cuts over the next six months

Despite negative headlines for tech, Nvidia down nearly 6% this month amid AI-bubble fears, and MicroStrategy down 40% amid crypto declines, retail investors have turned sharply bullish

JPMorgan reports $5.8 billion in net retail stock purchases this week, a big jump from last week’s $4.3 billion

Continued support also comes from $1 trillion in corporate stock buybacks over the past year

Wall Street is relying on the Supreme Court to protect the Fed. Is that wishful thinking? (CNN, 3 min read)

Wall Street has shown little reaction to President Trump’s public criticism of the Federal Reserve this year, but that stability now hinges on an upcoming Supreme Court case involving his attempt to remove Fed Governor Lisa Cook, the first such effort in the Fed’s 112-year history. A ruling in Trump’s favor could weaken the central bank’s independence in setting interest rates. For now, market indicators suggest steady confidence: the S&P 500 reached a record high three days after Trump announced Cook’s dismissal, and the 10-year Treasury yield has declined since spring, signaling that investors do not expect long-term inflation to accelerate

The Supreme Court is scheduled to hear arguments in late January, and a recent ruling in a separate case, explicitly noting it does not apply to the Fed, has been interpreted by analysts as reassuring

Markets are also watching the White House’s search for the next Fed chair, with Treasury Secretary Scott Bessent listing five candidates, including Kevin Hassett, Christopher Waller, and Michelle Bowman

The expectation that the eventual nominee will be broadly acceptable to markets has contributed to continued confidence in the Fed’s ability to operate independently

IPO & EXITS

Buy now, pay later: Earnouts help drive M&A activity (PitchBook, 3 min read)

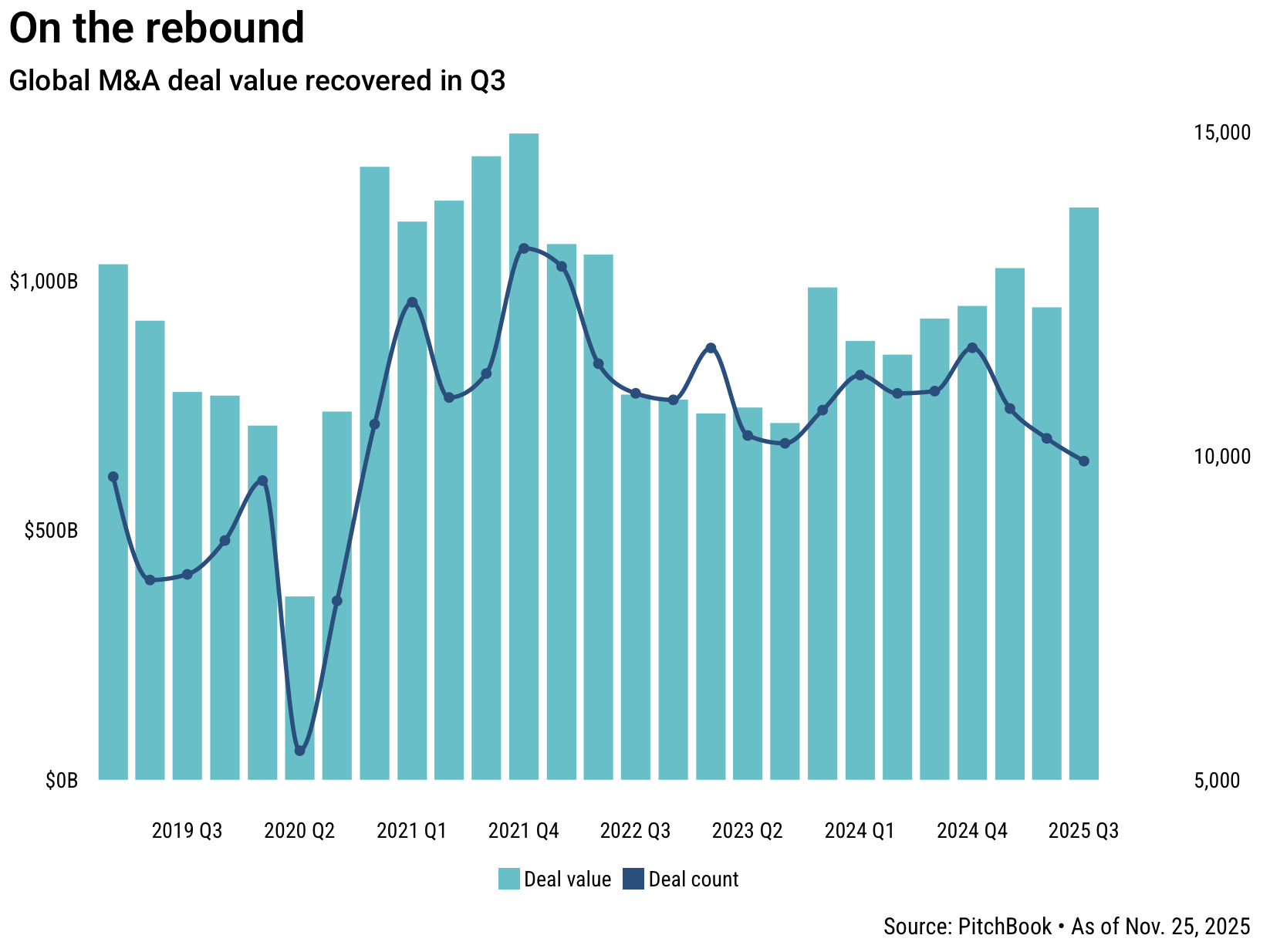

Global M&A activity has remained resilient despite economic uncertainty, with deal value reaching $1.1B in Q3 2025, the strongest quarter since 2021. Year-to-date M&A has already hit $3.9B, making it the second-highest total in a decade and 6% above 2024, though overall deal count is lower. The rebound contrasts with a weak Q2, when tariffs and geopolitical tensions widened valuation gaps between buyers and sellers. To close deals amid uncertain future earnings, earnouts have become increasingly common, now used in 39% of European small/mid-cap M&A, with 42% of advisors reporting rising use

Earnouts help bridge pricing gaps by tying part of the purchase price to performance milestones, though they can create future disputes if not clearly defined

Advisors note earnouts are gaining acceptance from sellers facing unpredictable conditions, especially tariff volatility and cost-pressure concerns

Buyers now favor EBITDA-based earnouts, while alignment tools like seller rollovers and detailed conduct provisions are becoming more common

Wall Street banks snap up venture secondaries firms in liquidity push (PitchBook, 5 min read)

Venture secondaries are surging, prompting Wall Street to acquire major players to meet rising demand for startup-share liquidity. In recent weeks, Goldman Sachs agreed to buy Industry Ventures for $665M plus up to $300M in earn-outs, and Morgan Stanley acquired EquityZen, gaining access to its 800,000 users and 49,000 transactions. The deals reflect consolidation in a historically fragmented market and growing pressure from institutional and retail clients seeking access to private-company shares such as OpenAI and SpaceX

Meanwhile, the U.S. VC secondary market hit a record $94.9B in Q3 2025 as investors look to unload stakes in overvalued 2021–2022 vintages

Experts say large banks are “playing catch-up,” while some institutional buyers increasingly bypass intermediaries to avoid fees, signaling the rapid institutionalization of venture secondaries and expectations of more acquisitions ahead

WHAT A TIME TO BE ALIVE

Embracing climate resilience (Infrastructure Investor, 5 min read)

Investors are increasingly recognizing how exposed their portfolios are to climate shocks. According to McKinsey & Company, in H1 2025, global climate catastrophes caused more than $162 billion in economic losses. While investment in clean energy infrastructure surpassed $2 trillion last year, the scale of climate impacts suggests this remains insufficient. In the US, recent political developments have added uncertainty to climate-focused investing, clouding short-term confidence

Yet the picture is far from uniform: states like California continue advancing resilience efforts, and New York has announced two adaptation grants totaling $26 million for 2025

Globally, commitment to climate resilience remains robust. The Nordic Development Fund, for instance, has deployed $131 million since 2009 into climate-related projects, with a strong emphasis on adaptation

Investors appear to be shifting from viewing climate resilience as a niche concern to treating it as a central driver of long-term value protection

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team