AI Gold Rush

Week of August 11th, 2025

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: Public Safety Leads, While Healthcare And Fintech Also See Big Deals (Crunchbase, 5 minute read)

First Due (Public Safety): Raised $355M in a strategic minority growth round led by JMI Equity. Founded in 2016, the Garden City, NY-based company provides software for over 3,000 U.S. and Canadian emergency response agencies

Strand Therapeutics (Biotechnology): Secured $153M Series B led by Kinnevik to advance mRNA-based therapeutics, following positive early clinical data for advanced solid tumor treatment

Apreo Health (Healthcare): Landed $130M Series B from Bain Capital Life Sciences and Norwest Venture Partners to fund severe emphysema treatment trials and commercialization

BeatBread (Financial Services): Raised $124M in debt and equity led by Citi Sprint to expand its platform enabling independent musicians to monetize their work

Decart (Artificial Intelligence): Closed $100M Series B at a $3.1B valuation from investors including Sequoia, Benchmark, Zeev Ventures, and Aleph, developing AI for interactive experiences

Startup Funding Outlook: VCs ‘Chasing The AI Wave’ But With Caution (Crunchbase, 5 minute read)

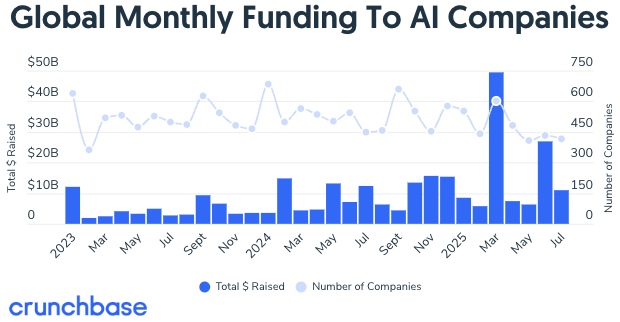

Global venture funding rose in early 2025, with Q2 investment reaching $91 billion, up 11% YoY, making H1 2025 the strongest since early 2022. AI remains the dominant driver, fueling rapid funding cycles, IPO activity, and sector expansion into areas like energy, semiconductors, supply chain, and defense tech. Menlo Ventures and Founders Fund see AI as the most transformative tech since the internet, with growth “still in early innings.” Left Lane Capital warns of 2021-like valuations for B2B AI but notes stronger fundamentals post-2022 correction

Back-to-back AI rounds are common, with valuations sometimes tripling in under a year, though overcrowding and overfunding risks persist

IPO sentiment is cautiously optimistic: recent strong debuts from Figma, ServiceTitan, Chime, and Circle show investor appetite, but only top-tier companies with growth, high margins, and strong customer demand are likely to succeed in the current market

41% of all VC dollars deployed this year have gone to just 10 startups (Pitchbook, 3 minute read)

In 2025, 41% of all U.S. VC funding—$81.3 billion—has gone to just 10 companies, eight of them AI startups, marking a 75% jump from the 23.4% share in 2024 and the highest concentration in over a decade. Overall, VCs have invested $197.2 billion so far this year. OpenAI alone raised $40 billion, the largest VC deal in history, while xAI raised $12 billion and Anthropic raised $8 billion

Investors cite the “winner-take-all” nature of today’s markets as justification for concentrating capital, but experts warn this reduces diversification and could put billions in LP capital at risk if valuations falter

The trend has also fueled fierce competition and FOMO-driven investing, with term sheets sometimes issued in just two weeks

Some VCs argue this reflects a shift toward consensus-driven, less ambitious strategies, potentially limiting innovation and broad-based startup growth

Startup Funding Stays Flat, But Figma IPO Lights A Spark In The Market (Crunchbase, 5 minute read)

Global venture funding reached $29.7 billion in July 2025, flat year over year but down from $43 billion in June. Despite the dip, AI remained the top-funded sector, attracting $11 billion (37% of total), while healthcare/biotech raised $5.7 billion and financial services doubled YoY to $4.6 billion. The U.S. accounted for $17 billion, or 58% of global totals. Funding was concentrated in large rounds, with $11.4 billion (38% of total) in deals of $200M+, led mainly by corporates and private equity

The largest round was xAI’s $5 billion raise, following OpenAI’s $40 billion and Meta’s $14.3 billion for Scale AI earlier this year

By stage, 10% of July funding went to seed, 30% to early stage, and 60% to late stage

Figma’s blockbuster IPO — priced at $33 and tripling on its first day — was the biggest tech debut since 2022 and could unlock more listings for revenue-generating, near-profitable unicorns

Still, $1 trillion remains tied up in 1,600+ private unicorns awaiting exit opportunities

Trump signs executive order opening 401(k)s to private markets (Pitchbook, 3 minute read)

President Donald Trump signed an executive order allowing 401(k) retirement accounts to invest in alternative assets such as private equity, real estate, and digital assets—options historically reserved for institutional and high-net-worth investors. The order directs the Department of Labor, SEC, Treasury, and other regulators to revise rules enabling defined-contribution plans to access these assets, aiming for better returns and diversification

The move, praised by private market leaders like Carlyle CEO Harvey Schwartz, is already spurring new retirement-focused investment products from firms like BlackRock and Blue Owl Capital

However, critics warn of transparency issues, limited liquidity, complex fee structures, and the need for greater investor education before exposing everyday workers’ savings to private markets

ECONOMIC SNAPSHOT

U.S. Government to Take Cut of Nvidia and AMD A.I. Chip Sales to China (The New York Times, 5 minute read)

Nvidia and AMD have reached a rare agreement with the Trump administration to pay the U.S. government 15% of revenue from AI chip sales to China in exchange for export licenses. The deal, struck after Nvidia CEO Jensen Huang met with President Trump, follows an April ban on such sales and could direct over $2 billion to the U.S. government this year. Nvidia is expected to sell $15 billion worth of its H20 chip to China, while AMD could sell $800 million of its MI308

The move marks a sharp reversal from earlier export restrictions aimed at preventing China from advancing its AI capabilities, sparking backlash from national security experts who warn it risks “selling national security for corporate profits”

Critics argue the H20 chip, while less powerful than Nvidia’s top models, could still accelerate China’s AI development

Supporters, including Huang, contend that allowing sales prevents Huawei from dominating the Chinese market and enables U.S. firms to reinvest in innovation

AI is creating new billionaires at a record pace (CNBC, 3 minute read)

The AI boom is fueling one of the fastest and largest wealth creation waves in history, minting dozens of new billionaires in 2025. Major fundraising rounds for companies like Anthropic, Safe Superintelligence, OpenAI, and Anysphere have pushed valuations to record highs, with 498 AI unicorns now worth a combined $2.7 trillion, 100 of them founded since 2023. Over 1,300 AI startups are valued above $100 million

This surge, coupled with soaring stock prices of AI leaders like Nvidia, Meta, and Microsoft, massive infrastructure investments, and high salaries for AI talent, is driving personal wealth growth at an unprecedented pace

Bloomberg estimates that just four major private AI firms created at least 15 billionaires worth $38 billion as of March, with more unicorns and fortunes, emerging since

Spending on AI data centers is so massive that it’s taken a bigger chunk of GDP growth than shopping—and it could crash the American economy (Fortune, 4 minute read)

In summer 2025, massive AI data center investment has, for the first time, contributed more to U.S. GDP growth than consumer spending, historically the nation’s primary economic driver. Microsoft, Google, Amazon, and Meta are leading the charge, with the “Magnificent Seven” tech giants spending over $100 billion on AI infrastructure in just three months, and forecasting $364 billion in 2025 alone

Fueled by generative AI’s computing demands, U.S. AI data center capex is nearing 2% of GDP, rivaling historical infrastructure booms like railroads and surpassing the dotcom telecom peak

Without this surge, GDP may have contracted amid weak job growth and macro uncertainty

The shift marks a structural change: America’s economy in 2025 is being powered less by household consumption and more by a concentrated, high-stakes race to dominate AI compute capacity

Trump's sweeping new tariffs take effect against dozens of countries (BBC, 4 minute read)

President Donald Trump’s new tariffs on over 90 countries have taken effect, marking the highest average U.S. tariff rate in nearly a century. Announced in April but delayed for negotiations, the measures impose varying rates, up to 40% for Laos and Myanmar, 39% for Switzerland, and 20% for Taiwan, with some allies like the UK, Japan, South Korea, and the EU securing lower rates through deals. Export-heavy Southeast Asian economies are among the hardest hit

Trump says the tariffs aim to boost U.S. manufacturing, reduce the trade deficit, and advance political goals, but critics warn of global disruption

Trump also asserted a 50% tariff on Indian goods over Russian oil purchases and a 100% tariff on foreign-made semiconductors, prompting Apple to announce a $100 billion U.S. investment

Tariffs on Canada and Mexico are tied to separate political negotiations, and talks with China continue ahead of an August 12 deadline

Trump's tariff revenue has skyrocketed. But how big is it, really? (NPR, 4 minute read)

President Trump’s expanded tariffs are generating tens of billions in new federal revenue, with the Treasury collecting $29 billion in customs and excise taxes in July alone, on track to surpass 2024’s total of $98 billion in just a few months. Tariffs now make up 2.7% of federal revenue, a modern-era high, and could reach 5% if rates remain. While Trump promotes tariffs as a way to pay down the $37 trillion national debt, experts note the revenue is still too small to make a meaningful dent and could be offset by slower economic growth and reduced income tax receipts

Over the next decade, tariffs are projected to raise $2–$3 trillion, far short of the $3.4 trillion cost of the GOP’s recently passed megabill

Future growth in tariff revenue faces limits: more domestic manufacturing could cut imports, court challenges could overturn key tariffs, and economic drag may reduce overall tax collections

IPO & EXITS

Figma’s $21 Billion Drop Returns Stock to Earth After IPO Frenzy (Bloomberg, 3 minute read)

Figma’s record-breaking IPO has turned volatile, erasing $21 billion in market value since peaking at $142.92 on Aug. 1. Shares now hover around $80, below their $85 opening price on July 31 but still more than double the $33 IPO price. The debut’s 250% first-day surge — the largest in 30 years for a U.S. IPO over $1 billion — was fueled by limited float (7% of shares) and heavy demand

The stock’s current $39 billion valuation gives it a price-to-sales ratio of ~37, far above peers like Adobe (<6x), Shopify, Intuit, and Workday, and second only to Palantir (90x) in the S&P 500

Analysts warn that without sustained momentum, investor attention could shift, as seen with other recent IPOs like Circle and CoreWeave, both down over 30% from highs despite triple-digit gains from their debut prices

Firefly Aerospace Stock Falters After First-Day IPO Pop (Investopedia, 2 minute read)

Firefly Aerospace (FLY) shares fell nearly 17% to about $50 on Friday, wiping out most of the gains from its high-profile debut the previous day. The Cedar Park, Texas–based space company raised nearly $870 million in an upsized IPO priced at $45 per share, with stock jumping 34% on Thursday to close at $60. Firefly, which counts the U.S. Space Force among its key clients, is the first private company to achieve a soft landing on the moon

Its listing comes after a turbulent history that includes bankruptcy and rocket-development setbacks

The IPO places Firefly in 2025’s cohort of $100 million-plus offerings — including Circle (CRCL) and Figma (FIG) — that have delivered a median first-day pop of over 18%, according to Renaissance Capital

The Renaissance IPO ETF is up 12% year-to-date, outperforming the S&P 500’s 8% gain, signaling renewed investor appetite for new public listings

Trump is planning a massive IPO of the government’s mortgage companies (CNN, 3 minute read)

President Donald Trump is considering a landmark IPO of up to 15% of Fannie Mae and Freddie Mac, potentially raising $30 billion, which could make it the largest IPO in history. The mortgage giants, under government conservatorship since the 2008 financial crisis, guarantee about 70% of U.S. mortgages and play a key role in keeping 30-year home loans viable. Trump’s push to take them public follows years of Republican calls to end government control

Proponents argue the companies are financially sound and could generate much-needed government revenue, while critics warn privatization could raise borrowing costs by $1,800–$2,800 annually for new mortgages and primarily benefit hedge fund investors

The White House has been in talks with major Wall Street banks, but no final decision has been made

Private equity weighs M&A risks; venture capital funding rounds fall (S&P Global, 5 minute read)

Global private equity and venture capital entry activity slowed in July 2025, totaling $52.6 billion across 911 deals — down from June and July 2024 levels — though year-to-date totals of $444.7 billion remain ahead of last year’s $403.1 billion. The pullback reflects caution over U.S. tariffs and macroeconomic uncertainty, with larger buyout funds targeting well-established companies and smaller deals facing more volatility in the middle market

Venture capital activity eased with $23.7 billion raised globally in July, down 13% from June, while deal count dropped 18% to 1,049

Despite this slowdown, 2025’s cumulative VC deal value of $217 billion is ahead of the $188 billion recorded over the same period in 2024

Major July transactions included: Blackstone’s $6.5 billion acquisition of Enverus and its ¥510 billion buyout of Japan’s TechnoPro Holdings and Apollo’s majority stake purchase in Stream Data Centers

WHAT A TIME TO BE ALIVE

US VC female founders dashboard (Pitchbook, 5 minute read)

Venture capital funding for female founders has stabilized following a sharp decline from 2021 peaks. While the share of total deals involving women-founded or co-founded companies has decreased, these companies are securing a growing proportion of the capital raised. A comprehensive dashboard tracks 16 years of U.S. investment trends for women founders, offering insights into deal counts, capital raised by state, industry, and stage, as well as highlighting notable female-founded startups and firms

In Q3 2025, co-founded female companies reported $3.9 billion in capital invested and a total of 186 deals, compared to $8.7 billion in capital and 395 deals in Q2 2025

In terms of deal count, so far in 2025, only female-led companies accounted for 5.8% of the total, while female and male-led companies together represented 17.5%

Regarding capital allocation, female-led companies received only 1.1%, whereas female and male-led companies collectively received 27.2%

8alpha.ai is an AI investment company transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team