Big Bets

Week of July 21st, 2025

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: Manufacturing, AI And Publishing Attract Investor Dollars (Crunchbase, 5 minute read)

Hadrian ($260M, Manufacturing): The AI-enabled aerospace and defense factory developer raised $260 million in Series C funding led by Founders Fund and Lux Capital, plus a factory expansion loan via Morgan Stanley

OpenEvidence ($210M, Medical AI):This Cambridge-based AI medical search tool for U.S. clinicians secured $210 million in Series B funding from Google Ventures and Kleiner Perkins

Substack ($100M, Publishing): The subscription-based platform for writers raised $100 million in Series C funding led by Bond and TCG

Perplexity ($100M, AI Search): The AI search challenger to Google raised $100 million at an $18B+ valuation, extending its previous round. Total funding now stands at $1.3 billion

Boulevard ($80M, SaaS for Self-Care):The salon and spa business management platform raised $80 million in Series D, led by JMI Equity, at a $800M post-money valuation

Larry Ellison surpasses Mark Zuckerberg to become world’s second-richest person after Oracle doubles down on AI investment (Fortune, 4 minute read)

Larry Ellison has become the world’s second-richest person at age 80, surpassing Mark Zuckerberg with a net worth of $251 billion, up nearly $60 billion in 2025 alone. His wealth is driven by a 40% stake in Oracle, whose stock is up 41% year-to-date amid strong earnings and intensified AI investments

Oracle is a founding member of Stargate, a $500 billion AI infrastructure initiative backed by the White House, alongside OpenAI, SoftBank, and MGX

The company also announced $3 billion in AI-focused investments in Europe, following fiscal Q4 revenues of $15.9 billion, up 11%, and total performance obligations of $138 billion

Meanwhile, Nvidia CEO Jensen Huang’s net worth rose to $149 billion, overtaking Warren Buffett, as AI stocks continue to outperform in the current market environment

Scale AI confirms ‘significant’ investment from Meta, says CEO Alexandr Wang is leaving (TechCrunch, 4 minute read)

Meta has invested approximately $14.3 billion for a 49% stake in Scale AI, valuing the data-labeling startup at $29 billion. As part of the deal, Scale AI CEO Alexandr Wang is stepping down to join Meta, where he will contribute to the company’s superintelligence efforts. Jason Droege, Scale’s chief strategy officer, will serve as interim CEO

Scale AI, which provides high-quality labeled data for training large language models, will remain independent

Meta's investment will help fund growth and provide liquidity to existing shareholders

The move is seen as Meta’s push to catch up in the AI race, as it lags behind competitors like OpenAI and Google

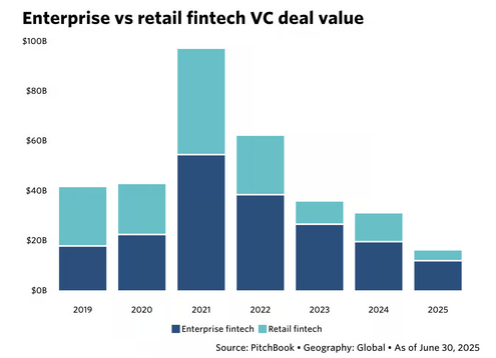

AI continues to push consumer fintech funding out of favor (Pitchbook, 3 minute read)

AI innovation in fintech is booming—mostly behind the scenes. So far in 2025, enterprise fintech startups have captured 74.6% of all fintech VC deal value, on track to match a decade-high record. While consumers experience some AI in neobanking or wealth tech apps, the real transformation is happening in enterprise, where AI is streamlining legacy systems like accounting, research, and business payments

Over 80% of U.S. fintech startups funded since 2021 with AI as a core feature are enterprise-focused, typically earning higher valuations and larger rounds

In contrast, investor appetite for consumer fintech remains low due to economic volatility and sensitivity to macro issues like tariffs

This enterprise-first trend is expected to dominate fintech VC allocations for the rest of the year

In Q2, Mexico Surpasses Brazil In Venture Dollars For First Time In Over A Decade (Crunchbase, 6 minute read)

In Q2 2025, Mexico overtook Brazil as Latin America’s top destination for venture capital funding for the first time in over a decade, raising $437 million—an 85% YoY and 81% QoQ increase—compared to Brazil’s $350 million, which saw a 23% YoY and 14% QoQ decline. The region as a whole raised $961 million in Q2, led by late-stage and growth deals, which doubled from Q1 to reach $547 million

Mexico’s Klar secured the quarter’s largest deal: a $170 million Series C valuing it at $800 million

Other major raises included Kavak’s $127 million growth round, Brazil’s New Wave with $120 million, and Chile’s Toku with $48 million

Local VC ecosystems—especially in São Paulo—are growing stronger, even as global funds recalibrate

ECONOMIC SNAPSHOT

Congress passes Genius Act, the first ever major crypto legislation in the US (3 minute read, Pitchbook)

The House approved the Genius Act—focused on setting standards for stablecoins pegged to the U.S. dollar—by a bipartisan vote of 308 to 122. The bill, championed by President Trump and backed by major crypto firms like Coinbase and Circle, now heads to his desk to be signed into law. Alongside it, the House also passed the Clarity Act, which outlines regulatory roles for the SEC and the Commodity Futures Trading Commission across the broader digital asset market. That bill moves next to the Senate for consideration

The votes followed a tense week of intra-party disagreement over surveillance concerns, ultimately resulting in the longest recorded vote in House history

Together, the two bills signal a major shift in how lawmakers view crypto, setting the stage for the first comprehensive regulatory framework in the U.S

Trump’s ‘big beautiful bill’ includes these key tax changes for 2025 — what they mean for you (CNBC, 4 minute read)

President Trump’s newly enacted tax law introduces sweeping changes set to take effect in 2025, reshaping how millions will file in 2026. Marketed as “working family tax cuts,” the law makes the 2017 tax cuts permanent, lowering brackets and doubling the standard deduction to $15,750 for individuals and $31,500 for married couples

The Child Tax Credit increases to $2,200 per child, and the SALT deduction cap temporarily rises to $40,000, but phases out between $500,000 and $600,000 of income, with marginal rates as high as 45.5%

New deductions for seniors ($6,000), tip income, overtime, and car loan interest aim to appeal to working-class voters, though many come with income limits

Meanwhile, the law fails to extend ACA premium subsidies, reviving the “subsidy cliff” in 2026, where a modest income increase could strip millions of their health insurance credits

Big Changes For QSBS: What The 2025 Trump Tax Bill Means For Founders And Investors (Mondaq, 5 minute read)

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act into law, enacting the most significant changes to Qualified Small Business Stock (QSBS) rules in over a decade. The reform introduces a tiered capital gains exclusion for stock acquired after that date: investors can now exclude 50% of gains after 3 years, 75% after 4 years, and 100% after 5 years, offering earlier liquidity while still incentivizing long-term holding

The lifetime per-issuer cap on excludable QSBS gains has been increased from $10 million to $15 million, with automatic inflation adjustments starting in 2027

The maximum asset threshold for companies to qualify as QSBS issuers has also been raised from $50 million to $75 million, potentially extending benefits to hundreds of later-stage startups

Crucially, all excluded gains under the 50%, 75%, and 100% tiers will no longer count as tax preference items for Alternative Minimum Tax (AMT) purposes, eliminating a major friction point for high-net-worth founders and investors

US inflation rose in June as Trump’s tariffs start to show in prices (The Guardian, 3 minute read)

U.S. inflation rose to 2.7% in June, up from 2.4% in May, as the effects of President Trump’s tariffs began to show in consumer prices. Core inflation, which excludes food and energy, also edged up to 2.9%. Prices for imported goods like appliances, furniture, and toys increased, while food prices rose 3%, with notable spikes in beef, coffee, and citrus. Egg prices, while falling recently, remain 27% higher than last year

The average U.S. tariff rate has climbed to 18.7%, the highest since 1933, including 30% tariffs on Chinese goods, 50% on steel and aluminum, and a blanket 10% tariff on all imports

Although inflation remains below pandemic-era peaks, tariffs have disrupted its downward trend

Despite Trump’s renewed push for interest rate cuts, the Federal Reserve is expected to hold rates steady amid continued inflation pressure and uncertainty around tariff impacts

Trump Has Promised More Tariffs on Mexico. What Happens Next? (The New York Times, 6 minute read)

President Trump has doubled down on his threat to impose a 30% tariff on Mexican imports starting August 1, citing the country’s failure to stop drug cartels and fentanyl trafficking. Despite previous praise for President Claudia Sheinbaum’s effort, Trump accused Mexico’s politicians of being controlled by cartels. He warned the tariff could be lifted only if Mexico “successfully challenges” cartel activity

Mexico, which became the U.S.’s largest trading partner in 2024, exported $506 billion in goods last year, with about 87% currently exempt from levies under USMCA

Trump’s letter did not clarify whether that exemption would remain, creating uncertainty that analysts say is already hurting Mexico’s economy

Meanwhile, business leaders urge Mexico to simplify negotiations and resolve sector-specific disputes to avoid broader economic fallout

Donald Trump pushes for 15%-20% minimum tariff on all EU goods (Financial Times, 4 minute read)

President Donald Trump has escalated U.S. trade demands with the European Union, now pushing for minimum reciprocal tariffs of 15%–20%, up from a previously discussed 10%. The EU has so far resisted, with Trump unmoved by the bloc’s latest offer to cut car tariffs. Talks have stalled ahead of an August 1 deadline, when Trump has threatened to impose a blanket 30% tariff on all EU imports

The EU is preparing countermeasures but remains divided on how to respond

If no deal is reached, Brussels could activate tariffs on up to €93 billion of U.S. imports, including goods like chicken, jeans, Boeing aircraft, bourbon, and potentially digital services

Still, concerns over sparking a broader trade war persist, especially given that the U.S. is the EU’s largest export market, accounting for 20% of its total exports

IPO & EXITS

Peter Thiel-backed cryptocurrency exchange Bullish files to go public on NYSE (CNBC, 2 minute read)

Bullish, a Peter Thiel-backed cryptocurrency exchange, has filed for an IPO and plans to list on the NYSE under the ticker “BLSH.” Led by former NYSE president Tom Farley, Bullish reported over $2.5 billion in average daily trading volume in Q1 2025 and claims over $1.25 trillion in total trading volume since launch. Backed by investors including Founders Fund, Thiel Capital, Nomura, and Mike Novogratz, Bullish also acquired CoinDesk in 2023

The IPO filing marks another milestone for the crypto sector’s push toward mainstream acceptance, following high-profile listings from Circle, eToro, Galaxy Digital, and a confidential filing by Gemini

The filing comes as Bitcoin trades above $117,000, and just days after President Trump signed the GENIUS Act, establishing consumer protections around stablecoin

Early-stage M&A powers VC exits as unicorns plump up (4 minute read, Pitchbook)

U.S. startup exits reached $67.7 billion across 394 deals in Q2 2025, up from $52.4 billion and 330 deals in Q1. While IPO activity is rebounding slightly, M&A remains the primary driver amid ongoing tariff-related uncertainty. Acquisitions made up 35.3% of exit deal volume and 31% of exit value in H1 2025. Most deals targeted early-stage startups, with 63.7% of acquisitions involving pre-seed, seed, or early-stage companies

Despite headline-making deals like Alphabet’s $32B purchase of Wiz and OpenAI’s $6.5B acquisition of Jony Ive’s startup, M&A has largely focused on younger firms, as high valuations for unicorns continue to slow late-stage transactions

The U.S. now has a record 841 unicorns, with 46 added in the first half of 2025

Investors say regulatory scrutiny under President Trump has been more muted than expected, encouraging smaller, strategic acquisitions

Fintech Comeback? IPOs Reignite Investor Optimism, But VC Funding Still Trails 2021 Highs (Crunchbase, minute read)

Global VC funding for fintech startups reached $22 billion in the first half of 2025—up 11.1% from H2 2024 and 5.3% year-over-year—marking the highest total in several quarters, though still far below the $68.7 billion peak of H1 2021. Deal volume dropped to 1,805, down 31.4% from H1 2024, signaling fewer but larger rounds. A surge of IPOs has renewed optimism

Enterprise fintech and AI-native startups are drawing investor attention

Firms like QED Investors, Sequoia, and MGX are leading larger rounds, with QED noting a return of “momentum” in AI-driven B2B infrastructure and climate-aligned financial services

Generalist funds are slowly returning, but the bar remains high: growth must be paired with strong fundamentals and real traction

WHAT A TIME TO BE ALIVE

Climate-focused PE funds are performing better than you think (3 minute read, Pitchbook)

Climate-focused private equity (PE) funds are outperforming traditional funds, thanks to advances in clean technologies, improved regulation, and growing consumer demand for sustainable products. Climate PE funds launched between 2016 and 2021 delivered slightly better returns, particularly in lower-performing market segments, suggesting resilience during downturns

Although the performance advantage narrows when adjusting for geography and vintage year, climate funds now perform on par with non-climate PE

Despite recent fundraising slowdowns, the sector’s assets under management could rise 20% to $563 billion by 2029 if competitive returns continue

8alpha.ai is an AI investment company transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team