Poaching?

Week of July 14th, 2025

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: Fintech Attracts Biggest Rounds While AI Holds Strong (Crunchbase, 5 minute read)

iCapital (Fintech): Raised $820 million (Round undisclosed) led by SurgoCap Partners and T. Rowe Price–advised accounts. The New York-based platform, which facilitates access to alternative investments, is now valued at $7.5 billion

Bilt Rewards (Fintech): Raised $250 million (Venture round) led by General Catalyst and GID, pushing its valuation to $10.75 billion. The New York-based company enables renters to earn rewards redeemable with local merchants

Also (Micromobility): Raised $200 million (Round undisclosed) led by Greenoaks, at a $1 billion valuation. The Palo Alto startup, spun out of Rivian, develops compact EVs with its first launch expected next year

Varda (Spacetech/Drug Discovery): Raised $187 million (Series C) led by Natural Capital and Shrug Capital. Based in El Segundo, California, the company uses microgravity to create novel pharmaceutical compounds in space

MaintainX (Industrial SaaS): Raised $150 million (Series D) from Bessemer Venture Partners, Bain Capital Ventures, and others. The San Francisco firm’s asset management software now holds a valuation of $2.5 billion

Q2 Global Venture Funding Climbs In A Blockbuster Quarter For AI And As Capital Concentrates In Larger Companies (Crunchbase, 6 minute read)

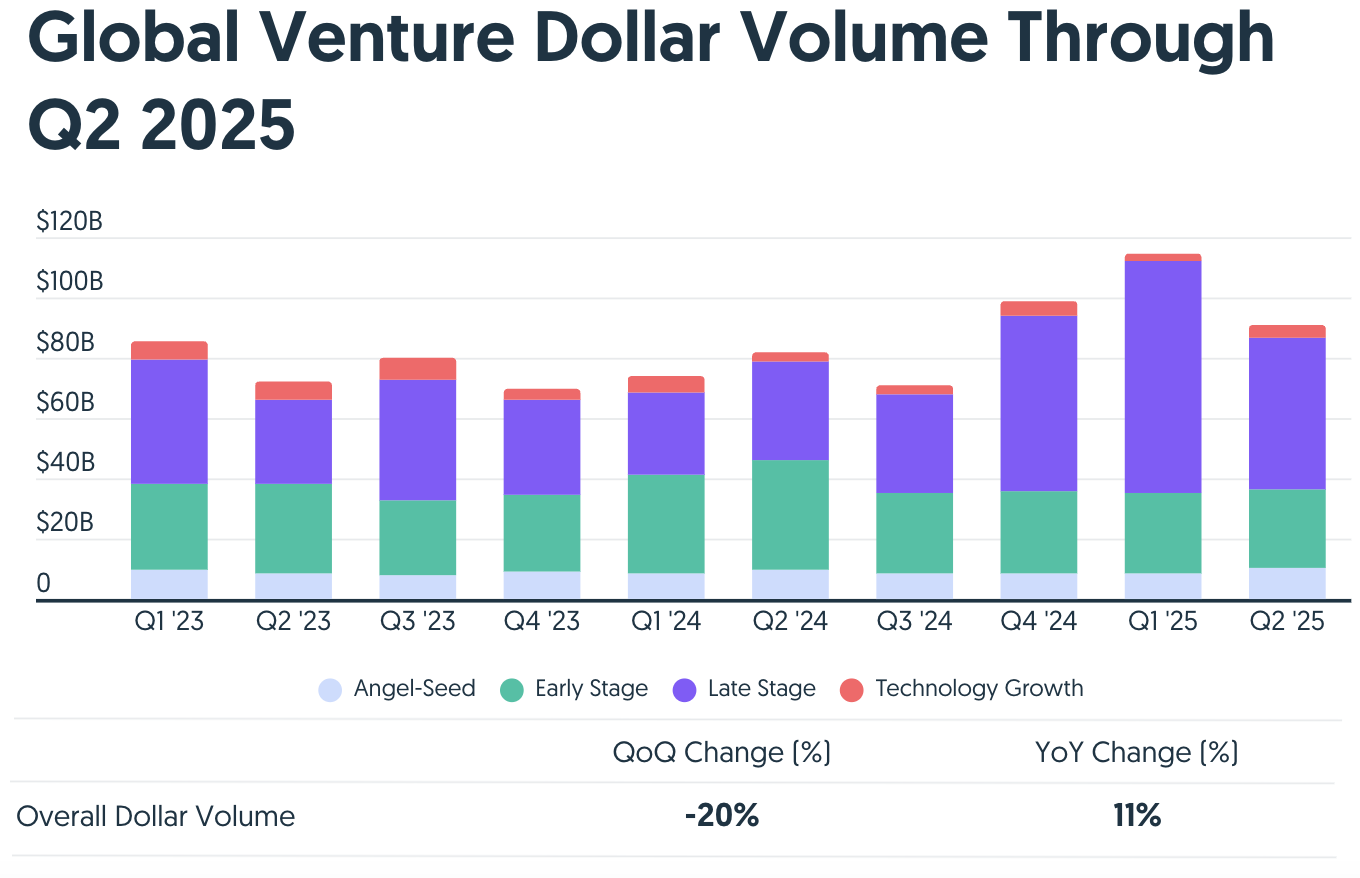

Global venture funding reached $91 billion in Q2 2025, up from $82 billion in Q2 2024 but down from $114 billion in Q1. This marks the third straight quarter of YoY growth, largely driven by massive rounds in AI. The sector attracted $40 billion, or 45% of total funding, with Scale AI alone raising $14.3 billion. The U.S. led globally, drawing $60 billion, or two-thirds of all VC dollars

The first half of 2025 brought in $205 billion, the strongest since H1 2022, with over $70 billion going to just 11 companies

M&A remained active, totaling $50 billion in Q2, led by OpenAI’s acquisitions

Late-stage funding grew 53% YoY, while early-stage remained flat at $26 billion

Zuckerberg's Meta Superintelligence Labs poaches top AI talent in Silicon Valley (Reuters, 5 minute read)

Meta is aggressively expanding its AI capabilities through its newly formed Superintelligence Labs, assembling one of the most high-profile teams in the industry to compete with OpenAI, Google, and Anthropic. Following setbacks like the underwhelming reception of Llama 4 and key departures, Meta is now recruiting top talent with offers reportedly reaching $100 million in bonuses. The team will be led by former Scale AI CEO Alexandr Wang as Chief AI Officer and ex-GitHub CEO Nat Friedman, who will co-lead applied AI products

Joining them are notable figures such as Daniel Gross (Safe Superintelligence), Ruoming Pang (Apple), Trapit Bansal (OpenAI), and others who have contributed to models like GPT-4o, Gemini, and ChatGPT

Google, DeepMind, OpenAI, and Anthropic veterans — including Joel Pobar, Jack Rae, Jiahui Yu, Pei Sun, and Johan Schalkwyk — are also part of the team

This talent surge underscores Meta’s determination to reclaim leadership in the AI race, even as regulatory pressure and fierce competition make the landscape increasingly volatile

ECONOMIC SNAPSHOT

Enduring confusion is the only certainty amid Trump’s latest tariff threats (The Guardian, 6 minute read)

President Trump has reaffirmed that tariffs will begin August 1, 2025, declaring there will be “no extensions”, despite quietly shifting the original July 9 deadline and securing just 3 trade deals out of the 300 initially promised. Federal Reserve Chair Jerome Powell has confirmed that tariffs are materially raising inflation forecasts. If most tariff rates land between 10–20%, as expected, the U.S. effective tariff rate would rise from 2.5% to levels last seen in the 1940s

Markets have largely shrugged off the threats: the S&P 500 hit a record high, despite early volatility, and the U.S. dollar is down 6.6% YTD, its worst first half in 50 years

Bond markets are pricing in four rate cuts over the next 12 months, reflecting expectations of a slowdown

Trump tariffs live updates: Canada, EU, Mexico set to be hit with 30% to 35% rates as Trump amps up threats (Yahoo Finance, 5 minute read)

President Trump is intensifying his global tariff agenda, announcing a 35% tariff on Canadian imports, followed by promised 30% duties on goods from Mexico and the EU. In total, more than 20 countries received tariff letters last week, with rates ranging from 20% to 40%, and a 50% levy on Brazil due to political tensions. In an interview, Trump also floated 15%–20% blanket tariffs on most trade partners, an increase from the current 10%, as part of a broader effort to pressure countries into trade deals

EU: Racing to negotiate before the August deadline while preparing retaliatory tariffs

Vietnam: Surprised by Trump’s claim of a 20% tariff deal; may face 40% tariffs on transshipped goods

India: Negotiating to keep tariffs under 20%, particularly after seeing Brazil penalized

Bitcoin Soars Past $120,000 as House Takes Up Crypto Bills (The New York Times, 5 minute read)

Bitcoin has surged past $122,000, more than doubling year over year and signaling the growing strength of the crypto sector under the Trump administration. The rally comes as the House prepares to advance major crypto legislation — including the GENIUS Act on stablecoins, the Digital Asset Market Clarity Act, and the Anti-CBDC Surveillance State Act — in what Republicans are calling “crypto week.” Pro-crypto lawmakers argue the moves will help cement U.S. leadership in digital innovation, drawing $2.7 billion in inflows into U.S. Bitcoin ETFs last week alone

Still, critics like Rep. Maxine Waters warn the industry is reaping rewards for backing Trump and enabling potential conflicts of interest, while others worry about regulatory capture

The broader financial backdrop is also driving crypto’s gains, with anticipated monetary easing and economic uncertainty boosting Bitcoin’s appeal

Meanwhile, markets are bracing for further turbulence as Trump threatens new 30% tariffs on the EU and Mexico, adding to ongoing inflation concerns and Fed pressure

IPO & EXITS

Windsurf’s CEO goes to Google; OpenAI’s acquisition falls apart (TechCrunch, 4 minute read)

OpenAI’s $3 billion acquisition of AI coding startup Windsurf has collapsed. In a surprise move, Google DeepMind is hiring Windsurf’s CEO Varun Mohan, co-founder Douglas Chen, and several top researchers, while licensing the startup’s technology for $2.4 billion. Google will not acquire or control Windsurf, but it will gain non-exclusive rights to its tools.Windsurf, with an ARR of $100 million as of April, was one of the fastest-growing AI coding startups

The deal marks another “reverse-acquihire” in AI, allowing Google to strengthen its coding capabilities without triggering regulatory scrutiny

The failed deal adds tension between OpenAI and Microsoft, as OpenAI reportedly sought to prevent Windsurf’s IP from landing with its largest backer

Windsurf’s future is uncertain, with past examples suggesting companies often lose momentum after losing founding leadership

Shein files for Hong Kong IPO in hopes of salvaging London listing: FT report (CNBC, 4 minute read)

Fast fashion giant Shein has confidentially filed for an IPO in Hong Kong, aiming to pressure U.K. regulators and revive its long-stalled listing ambitions. The Chinese-founded, Singapore-based retailer submitted a draft prospectus to HKEX last week while also seeking approval from China’s Securities Regulatory Commission (CSRC). Shein had previously attempted a London listing, but negotiations stalled due to disagreements between U.K. and Chinese regulators over risk disclosure. Although the U.K.’s FCA approved an earlier draft, the CSRC rejected it, objecting to the proposed language

A May EU investigation found the company in breach of consumer protection laws, while the U.S. and potentially the EU and U.K. are moving to close de minimis import loopholes, which have benefited Shein’s low-cost model

While some analysts see a Shein listing as a possible ESG turnaround opportunity, others emphasize the need for investor protections and regulatory integrity

India on track for record IPO year (Financial Times, 4 minute read)

India has raised $6.7 billion in IPOs year-to-date, up from $5.4 billion during the same period in 2023, positioning it as the largest IPO market outside the U.S., according to Dealogic. Driven by strong domestic demand, rate cuts, and a rebounding economy, India could surpass its $21 billion total from last year, especially with major offerings like Tata Capital’s $2 billion IPO expected

The Nifty 50 index has risen 7% this year amid easing inflation and a full 1% interest rate cut by the Reserve Bank of India

Domestic investors, buoyed by tax cuts and economic optimism, have injected over $42 billion into equities, offsetting $8 billion in foreign outflows

Recent IPO successes, including HDB Financial Services (+5%) and Hexaware (+15%), have increased market confidence

WHAT A TIME TO BE ALIVE

The new face of wealth: The rise of the female investor (McKinsey & Company, 10 minute read)

Women are becoming a dominant force in global finance, currently controlling an estimated $60 trillion—or 34%—of global assets under management (AUM). By 2030, that share is expected to grow to 40–45% in the U.S. and EU, unlocking a $10 trillion opportunity from currently unmanaged wealth. Between 2018 and 2023, global financial wealth rose by 43%, while female-controlled wealth grew faster, at 51%. In the U.S., women’s controlled assets surged from $10 trillion in 2018 to $18 trillion in 2023 and are projected to reach $34 trillion by 2030

Despite this growth, 53% of assets controlled by women remain unmanaged—compared to 45% for men—highlighting a service gap in wealth management

Only 18–23% of financial advisors are women, and many firms still default to men as the primary financial decision-makers in households

8alpha.ai is an AI investment company transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team