$100,000

What has President Trump said this week?

〰️

What has President Trump said this week? 〰️

1. $100,000 Fee for H-1B Visas

The Trump administration announced a new policy requiring companies to pay a $100,000 fee for each H-1B visa, a program widely used to bring highly skilled foreign workers in technology, engineering, and research (The Guardian, 2025). The H-1B program has long enabled U.S. firms, especially in Silicon Valley, to recruit talent from India, China, and other countries. Supporters say the measure is intended to protect U.S. workers and raise federal revenue.

Corporate America has reacted cautiously, with many firms voicing concerns that the steep fee will deter companies, especially startups and smaller enterprises, from accessing global talent. Larger firms may be able to absorb the cost, but early-stage companies dependent on specialized workers could face significant challenges (Bloomberg, 2025). Analysts warn the steep fee could slow innovation and investment in the U.S. technology sector, potentially shifting jobs and research abroad (The Guardian, 2025).

The policy may also discourage foreign entrepreneurs and skilled workers from relocating to the U.S., reducing competitiveness in the American tech ecosystem.Politically, President Trump has framed the fee as part of his “America First” agenda and his commitment to prioritizing American jobs, pushing corporations to invest more in domestic talent (Axios, 2025).

2. TikTok Sale Confirmed

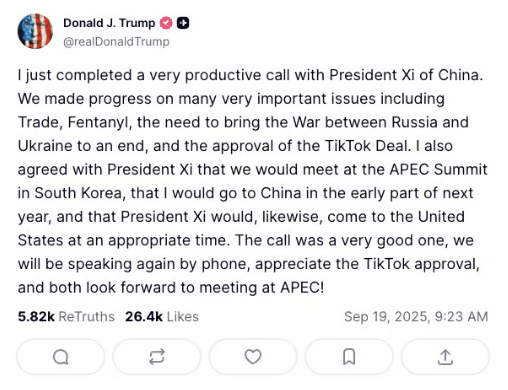

President Trump confirmed via Truth Social that the U.S. government has approved the sale of TikTok’s American operations, ending months of speculation and geopolitical tension (Truth Social, 2025). The deal involves Oracle controlling american TikTok users' data in their cloud infrastructure while a consortium of investors, including Oracle’s CEO Larry Ellison, Michael Dell, CEO of Dell Technologies, and the Murdoch family through Fox Corp. TikTok's U.S. operations would be run by a new joint-venture company governed by U.S. investors, complying with the bipartisan law passed in 2024 (NBC News, 2025; CNN, 2025).

The agreement is seen as a compromise between Washington and Beijing. For the U.S., it addresses national security concerns over Chinese data access, while for China, retaining limited oversight of TikTok’s recommendation algorithm allows some influence to remain. The transaction followed direct talks between President Trump and President Xi Jinping, underscoring both economic pragmatism and political strategy (The Guardian, 2025).

Economically, the sale is expected to stabilize tensions in the tech sector, provide clarity for social media influencers, and reassure markets worried about U.S.-China decoupling. For private equity investors, the case highlights the importance of weighing political and regulatory risks in cross-border technology investments. Analysts suggest the outcome could set a precedent for future national security-driven deals in sensitive industries.

3. Rate Cuts vs. Tariffs: A Mixed Outlook

A new Reuters/Ipsos poll found President Trump’s approval ratings dipped slightly as Americans express growing concerns about the economy (Reuters, 2025). Although the recent Federal Reserve rate cut has eased some credit pressures, tariffs imposed under Trump’s trade policies continue to weigh on global markets and U.S. consumer prices. Analysts suggest that while lower rates may boost financing conditions, tariffs and trade frictions complicate the outlook for sustained growth (Washington Post, 2025).

The combination of accommodative monetary policy and restrictive trade measures creates a mixed environment. Private equity investors benefit from lower borrowing costs that support leveraged buyouts, yet tariffs introduce uncertainty in supply chains and international markets, complicating portfolio strategies. Globally, observers are watching how these opposing forces will affect trade-dependent sectors such as manufacturing, retail, and technology (New York Times, 2025).

Trump’s policies remain aligned with his America First agenda, emphasizing protectionism alongside monetary relief. However, voter unease with inflation and trade frictions is reflected in the poll numbers. For investors, the challenge lies in navigating short-term opportunities from lower borrowing costs against long-term risks tied to protectionism and global trade instability.