Trade Truce

What has President Trump said this week?

〰️

What has President Trump said this week? 〰️

1. Tariff Costs: Conflicting Perspectives

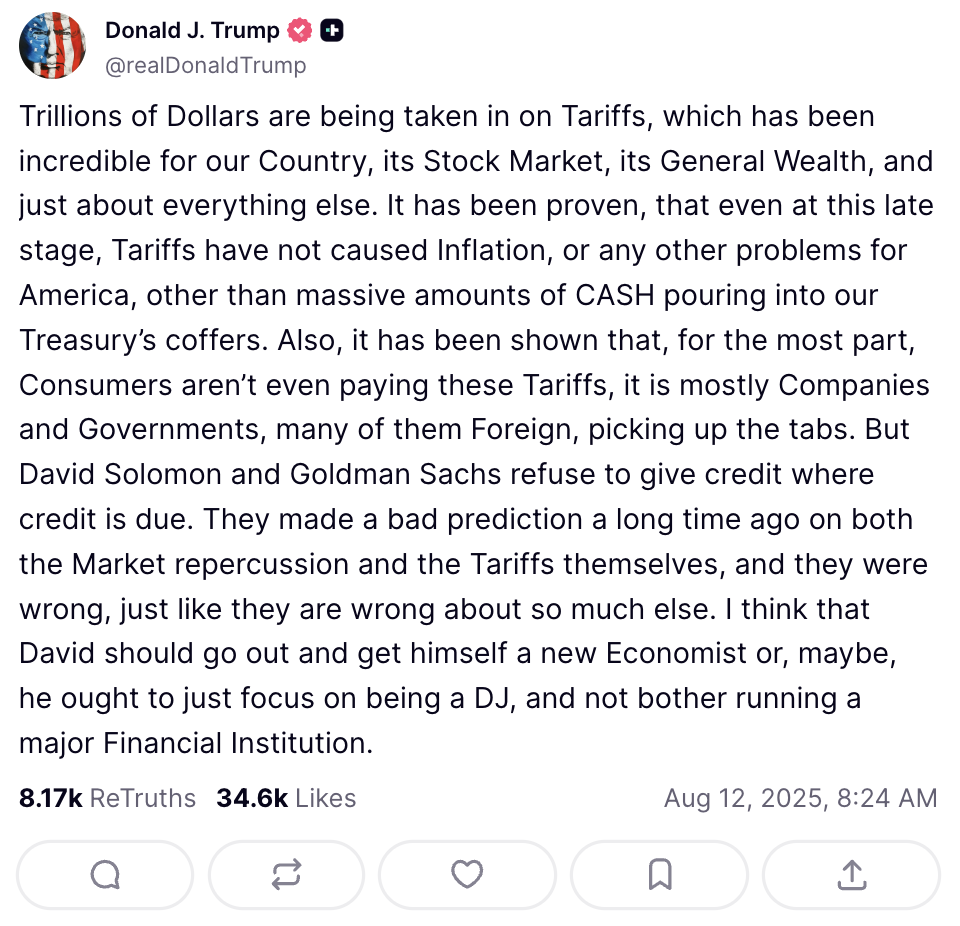

Trump recently addressed Goldman Sachs’ economic forecasts regarding tariffs on Truth Social, asserting that foreign entities—not U.S. consumers—bear most of the cost (Truth Social, 2025). He questioned the bank’s assessment and suggested it underestimates the benefits of his tariff policies.

Goldman’s economists estimate that while businesses have absorbed roughly 64% of the tariff burden so far, consumers are expected to shoulder approximately 67% by October, significantly impacting household budgets (Business Insider, 2025; Politico, 2025). Goldman’s chief U.S. economist, David Mericle, stated the team will “keep doing” data-driven analysis despite political pushback (Reuters, 2025).

The debate comes as the U.S. and China extended their trade truce for another 90 days, delaying planned tariff hikes until November 10 (BBC, 2025). Under the extension, the U.S. will maintain a 30% levy on Chinese imports, while China will keep a 10% tariff on U.S. goods. The pause follows earlier tensions that saw threats of tariffs exceeding 100% on both sides and comes with a renewed commitment to address trade imbalances, market access, and national security concerns.

Economically, these tariffs are adding to inflationary pressures, particularly in electronics, appliances, and automobiles—forcing companies to raise prices. Trump continues to frame the strategy as effective, while independent forecasts point to rising consumer costs. The contrast between political messaging, independent analysis, and ongoing trade negotiations could influence market confidence and voter sentiment as the election approaches.

2. D.C. Police Federalized

On August 11, President Trump announced plans to federalize the Metropolitan Police Department in Washington, D.C., and deploy the National Guard to strengthen local law enforcement (Washington Post, 2025). The administration framed the decision as a response to rising violent crime rates and operational inefficiencies.

Mayor Muriel Bowser described the move as “unsettling and unprecedented,” noting the limited ability of the city to contest the action due to its status as a federal district rather than a state (Politico, 2025). The shift raises questions about municipal autonomy, federal authority, and constitutional limits on local governance.

The move aligns with Trump’s broader “law and order” agenda, which may appeal to voters prioritizing public safety. However, critics warn of risks to civil oversight, potential politicization of law enforcement, and erosion of home rule in D.C. Given the precedent-setting nature of the federal intervention, legal challenges or legislative pushback could follow.

3. Is Trump the Highest-Polling Republican President in History?

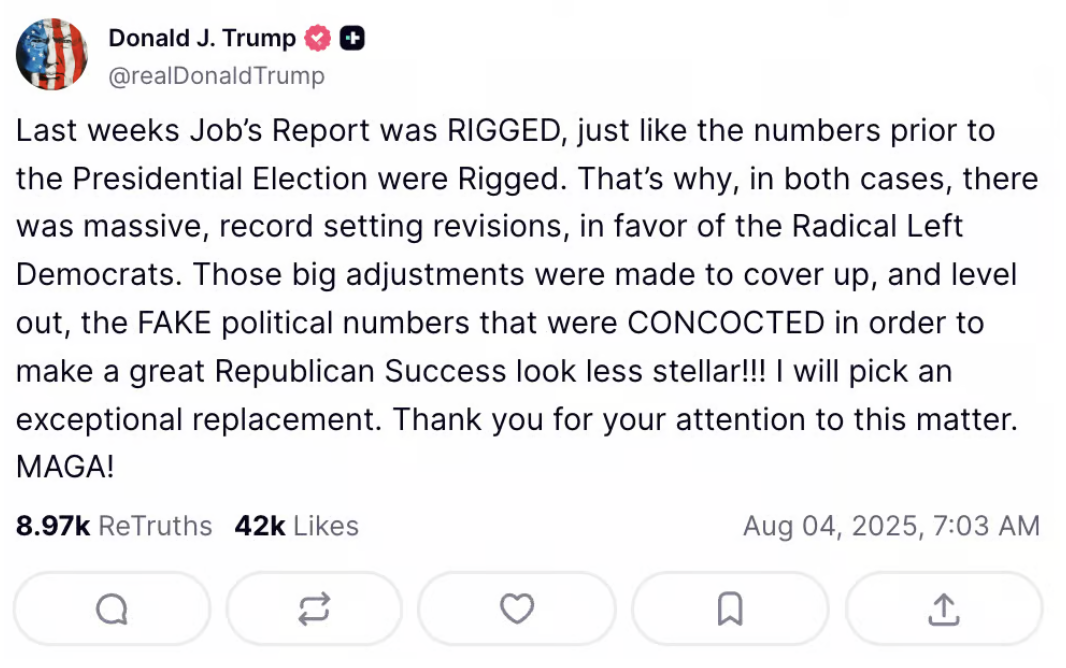

On August 13, President Trump stated on Truth Social that he is the “highest-polling Republican President in history” (Truth Social, 2025).

Independent polling data does not fully support this claim. While Trump’s approval ratings are strong among Republican voters, they do not exceed historical records when measured across the broader U.S. population. Gallup and other polling averages place his approval in the mid-40 percent range—comparable to or slightly below several of his Republican predecessors (Gallup, 2025; Forbes, 2025).

Historical comparisons indicate that his current ratings fall within typical bounds for Republican presidents in office,rather than setting a new high. Trump began his second term with a 52% approval rating, and as of July 2025 holds a 37% approval rating (Gallup, 2025).