Slower Hiring, Higher Stakes

What has President Trump said this week?

〰️

What has President Trump said this week? 〰️

1. December Jobs Report

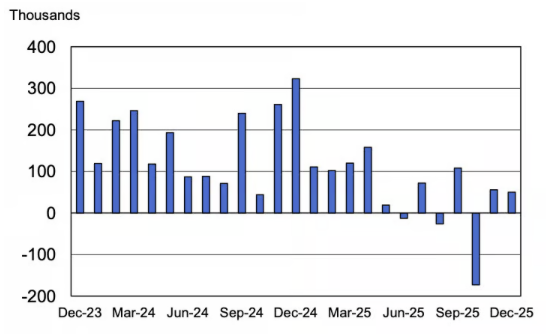

The December U.S. jobs reportconfirmed a sharp loss of momentum in the labor market at the end of 2025. Employers added 50,000 jobs in December, falling short of expectations of roughly 55,000–73,000 and down from a downwardly revised 56,000 gain in November. October payrolls were also revised lower, showing a loss of 173,000 jobs (BLS, 2026; CNN, 2026; The Washington Post, 2026). For the full year, payroll growth totaled 584,000 jobs, making 2025 the weakest year for job creation outside a recession since 2003. Hiring was concentrated almost entirely in leisure and hospitality and health care, while retail, manufacturing, construction, and professional services shed jobs, pointing to a broad-based hiring slowdown. Despite weak job growth, the unemployment rate edged down to 4.4%, reflecting low layoffs and reduced labor force participation rather than stronger demand. Meanwhile, average hourly earnings rose 0.3% on the month and 3.8% year over year, modestly outpacing inflation (CNBC, 2026).

Nonfarm payroll employment over-the-month change, seasonally adjusted, December 2023-December 2025. Source: Bureau of Labor Statistics. (2026, January 9). The employment situation — December 2025 (USDL-26-0020) [PDF]. U.S. Department of Labor. https://www.bls.gov/news.release/pdf/empsit.pdf

Beneath the headline figures, labor-market conditions appear increasingly restrictive for households. The number of people unemployed for 27 weeks or longer rose to 1.9 million, up 397,000 over the year, indicating longer jobless spells. New York Fed survey data show one-year inflation expectations increasing to 3.4%, while the perceived probability of finding a job after job loss fell to 43.1%, the lowest on record. At the same time, 15.3% of respondents reported a likelihood of missing a minimum debt payment, the highest since April 2020. These indicators suggest growing concern about job security and household finances, even as headline unemployment remains relatively low (Bloomberg, 2026).

Financial markets view this combination of weak hiring, firm wages, and elevated inflation expectations as limiting near-term policy flexibility. Slower job growth raises downside risks to employment, while persistent inflation pressures complicate the case for early rate cuts. As a result, markets expect the Federal Reserve to hold rates steady in the near term, with any easing pushed later into 2026 (CNBC, 2025; Bloomberg, 2026).

2. The Fed Under Investigation

Federal Reserve Chair Jerome Powell said the Department of Justice has issued grand jury subpoenas related to his June testimony before the Senate Banking Committee on cost overruns associated with the renovation of the Fed’s headquarters, raising the possibility of criminal charges. Powell described the move as unprecedented and said it reflects escalating political pressure rather than a standard oversight review. The Justice Department has said the investigation began in November and is examining potential discrepancies between contractor filings and Powell’s testimony concerning the $2.5 billion renovation project. Powell has denied any wrongdoing and said the Fed repeatedly disclosed project details to Congress (Federal Reserve, 2026; Bloomberg, 2026; The Washington Post, 2026).

The renovation has drawn scrutiny primarily because of its rising cost, which the Fed has attributed to construction inflation, engineering complexity, extensive underground work, and heightened regulatory and security requirements that have lengthened timelines and increased expenses (Bloomberg, 2025). The political context has amplified the issue, as the investigation comes amid President Trump’s repeated public criticism of Powell and the Federal Reserve, raising concerns in financial markets about potential political constraints on monetary policy (The Washington Post, 2026).

Institutional reaction has been strong. Former Federal Reserve chairs and former Treasury secretaries issued a joint statement condemning the probe and warning that it could undermine confidence in U.S. monetary governance. In a show of support, international central bankers have also spoken out in defense of Powell, underscoring concerns about preserving central-bank independence. Powell has reiterated that his testimony was accurate and that Federal Reserve policy decisions remain guided by economic data and the Fed’s statutory mandate, not political considerations (Federal Reserve, 2026; Bloomberg, 2026).

3. Trump’s Housing Affordability Push

President Trump has made housing affordability a central policy focus, arguing that growing participation by large institutional investors has driven up home prices and reduced access for first-time buyers. The administration is exploring measures to limit Wall Street firms from purchasing single-family homes, reinforcing a broader effort to prioritize owner-occupants over rental portfolios (The Washington Post, 2026). Financial markets reacted immediately: shares of major institutional housing investors fell after Trump said he was “immediately taking steps” toward a ban, with Blackstone declining nearly 6%, Invitation Homes down about 6%, and American Homes 4 Rent falling more than 4%. Analysts cautioned that the ultimate impact will depend on policy design, particularly whether existing holdings are exempted or subject to divestment (Bloomberg, 2026).

At the same time, the administration has directed a $200 billion purchase of mortgage-backed securities (MBS) through Fannie Mae and Freddie Mac, the government-sponsored enterprises that underpin the U.S. housing finance system (Bloomberg, 2026). Increased MBS purchases tend to raise bond prices and lower yields, which can ease mortgage rates and support housing demand. The initiative has reopened broader questions about the long-term role and structure of Fannie and Freddie, including how actively the federal government should intervene in housing finance to influence affordability (The New York Times, 2026).

The policy trade-offs are substantial. While lower mortgage rates can stimulate demand, in a housing market constrained by limited supply, stronger demand may push prices higher, diluting affordability gains (The Guardian, 2026). Ultimately, the effectiveness of these measures will hinge on implementation details, such as the scope of investor restrictions, the scale and duration of MBS purchases, and whether complementary policies meaningfully expand housing supply or improve access for owner-occupant buyers (The Washington Post, 2026; Bloomberg, 2026).