Fed Pulse Check

Week of November 3rd, 2025

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: AI, Fintech And E-Commerce In The Lead (Crunchbase, 5 min read)

Mercor (AI Hiring): San Francisco-based Mercor, which develops AI-driven hiring tools raised $350 million in Series C funding at a $10 billion valuation. The round was led by Felicis, with participation from Robinhood Ventures, General Catalyst, and Benchmark

SavvyMoney (Fintech): Dublin, California-based SavvyMoney secured $225 million in a round co-led by PSG Equity and Canapi Ventures. Founded in 2009, the company powers credit score and offer personalization tools for over 1,500 financial institutions

Whatnot (E-Commerce): Live shopping platform Whatnot closed a $225 million Series F, doubling its valuation to $11.5 billion in under a year. The DST Global and CapitalG–led round brings the Los Angeles-based startup’s total funding to $968 million since its 2019 launch

Sublime Security (Cybersecurity): Washington, D.C.-based Sublime Security raised $150 million in Series C funding led by Georgian, bringing its total to $240 million. The company builds agentic AI tools to detect and prevent email-based threats

Harvey (Legal Tech): AI legal platform Harvey raised $150 million, led by Andreessen Horowitz, reaching an $8 billion valuation. The San Francisco-based company has now raised $1 billion total to advance its AI-powered tools for law firms and legal departments

In The Space Of Months, AI Funding Boom Adds More Than $500B In Value To Unicorn Board And Reshuffles Top 20 (Crunchbase, 4 min read)

The Crunchbase Unicorn Board surpassed $6 trillion in total value in August 2025, just 18 months after crossing the $5 trillion mark, and has since added another $500 billion, driven largely by the AI boom. Frontier model companies and new decacorns are fueling record valuations, with OpenAI jumping $200 billion in six months to reach a $500 billion valuation, overtaking SpaceX ($400B) as the world’s most valuable private company. Anthropic rose to $183B, Databricks hit $100B, and Canva reached $42B

Eleven new decacorns emerged in H2 2025, including Figure (up 1,300% to $39B), Kraken ($15B), Mistral ($13.2B), Oura ($11B), and Crusoe Energy Systems ($10B)

In total, there are now 82 private companies valued above $10 billion, with more than a third raising new rounds this year

The surge signals renewed late-stage market strength and could foreshadow a revival in IPO activity heading into 2026

Microsoft, OpenAI reach deal removing fundraising constraints for ChatGPT maker (Reuters / Yahoo Finance, 5 min read)

Microsoft and OpenAI announced a sweeping restructuring deal that transforms the ChatGPT maker into a public benefit corporation (PBC), freeing it from nonprofit funding limits and setting the stage for a potential IPO to finance CEO Sam Altman’s $1.4 trillion vision for global data center expansion. The move allows OpenAI to raise capital more flexibly and operate more like a traditional tech company while remaining controlled by the nonprofit OpenAI Foundation, which will hold a 26% stake and retain board oversight

Under the new arrangement, Microsoft keeps a 27% ownership stake, valued at roughly $135 billion, nearly 10x its $13.8 billion investment, but loses its exclusive rights to supply computing resources and any claim over OpenAI’s future hardware products

OpenAI will continue sharing about 20% of its revenue with Microsoft until 2032, when their existing cloud contract and revenue-sharing agreement are expected to conclude

Altman confirmed that an IPO is “the most likely path” forward as OpenAI evolves from a product company into a platform ecosystem, enabling developers to build services atop its technology

Microsoft shares once again surpass $4 trillion valuation, joining Nvidia (ABC News, 3 min read)

Microsoft reclaimed a spot in the $4 trillion valuation club, closing at $4.04 trillion after its shares rose 2% to $542.07, following OpenAI’s corporate restructuring into a public benefit corporation. The reorganization, approved by Delaware and California regulators, also formalized Microsoft’s new 27% ownership stake in OpenAI’s for-profit arm, deepening the companies’ already extensive AI partnership

The rally puts Microsoft alongside Nvidia, whose AI chips have made it the world’s most valuable company, and just ahead of Apple, which briefly hit $4 trillion earlier Tuesday before closing at $3.99 trillion

Apple, the first firm to ever reach the $1T, $2T, and $3T milestones, now faces growing competition from AI leaders reshaping market dynamics

Together, Microsoft, Nvidia, and Apple dominate global investor attention, reflecting how AI-driven growth has become the defining force of the modern tech economy

The State Of Startups: These Sectors And Stages Are Down As AI Megarounds Dominate In 2025 (Crunchbase, 4 min read)

Global venture funding rebounded sharply in Q3 2025, totaling $97 billion, one of only four quarters above $90 billion since the 2022 correction. But unlike the broad-based boom of 2021, today’s surge is heavily concentrated in artificial intelligence, with AI startups capturing 46% of global funding, nearly a third of it from Anthropic’s $13 billion raise. Megarounds ($100M+) now dominate the market, accounting for 60% of global and 70% of U.S. venture capital, rivaling 2021’s totals but with far fewer beneficiaries

Early-stage and seed deals have declined sharply, suggesting investors are favoring large, established AI players over emerging startups

Sectors like biotech and cybersecurity have hit multi-year funding lows, while legal tech and HR software are seeing renewed interest driven by automation trends

Asia saw growth thanks to hardtech rounds, Europe raised $13.1B, buoyed by early-stage activity and Klarna’s IPO, and Brazil retook the top spot in Latin America

Nvidia becomes first public company worth $5 trillion (TechCrunch, 3 min read)

Nvidia has become the first public company to surpass a $5 trillion market capitalization, cementing its position as the biggest winner of the AI boom. Its shares jumped 5.6% to $212.19 after President Donald Trump announced plans to discuss Nvidia’s Blackwell chips with China’s Xi Jinping, and following CEO Jensen Huang’s forecast of $500 billion in AI chip sales. The company is building seven U.S. supercomputers across national security, energy, and science sectors, and recently invested $1 billion in Nokia to help launch AI-native 5G and 6G networks

Nvidia’s stock has surged over 50% in 2025, driven by surging demand for its GPUs used in AI training and inference, which remain in tight supply

The milestone comes just three months after crossing $4 trillion, fueled by multibillion-dollar AI infrastructure deals and a planned $100 billion investment in OpenAI

At $5 trillion, Nvidia is now worth more than every national stock market in the world except those of the U.S., China, and Japan

Amazon Stock Jumps on $38 Billion OpenAI Deal. What We Know (Barron’s, 1 min read)

OpenAI has signed a $38 billion, seven-year deal with Amazon Web Services (AWS) to power its AI workloads using hundreds of thousands of Nvidia GPUs. The partnership, which begins immediately, will make AWS a key infrastructure provider for OpenAI alongside Microsoft and Oracle. Amazon said the new capacity will be fully deployed by the end of 2026, with options to expand beyond 2027. OpenAI CEO Sam Altman called the deal part of a “broad compute ecosystem” supporting the next era of AI

The agreement, though massive, is smaller than OpenAI’s other recent cloud partnerships, including a $250 billion Azure deal with Microsoft and a $300 billion commitment with Oracle

Amazon shares rose 4.9% following the news, while Microsoft gained 0.5% and Nvidia climbed 3.8%, reflecting investor optimism about accelerating AI infrastructure demand

ECONOMIC SNAPSHOT

Fed cuts US interest rates again despite 'flying blind' (BBC, 3 min read)

The Federal Reserve cut interest rates by 0.25 percentage points to a range of 3.75%–4%, its lowest level in three years, as it prioritized a weakening labor market over inflation concerns. The move came despite the ongoing U.S. government shutdown, which has stalled key economic data releases and left policymakers “flying blind.” Two Fed members dissented, one pushing for a larger cut, another for no change, underscoring growing divisions within the central bank

Fed Chair Jerome Powell described the labor market as “less dynamic and somewhat softer,” with hiring slowing and unemployment edging higher

Private data from ADP showed the economy lost 32,000 jobs in September, reinforcing concerns about job growth

Inflation, meanwhile, eased to 3% year over year, slightly below expectations

The Fed also announced plans to end the reduction of its balance sheet, a process of shrinking its pandemic-era asset holdings, starting December 1

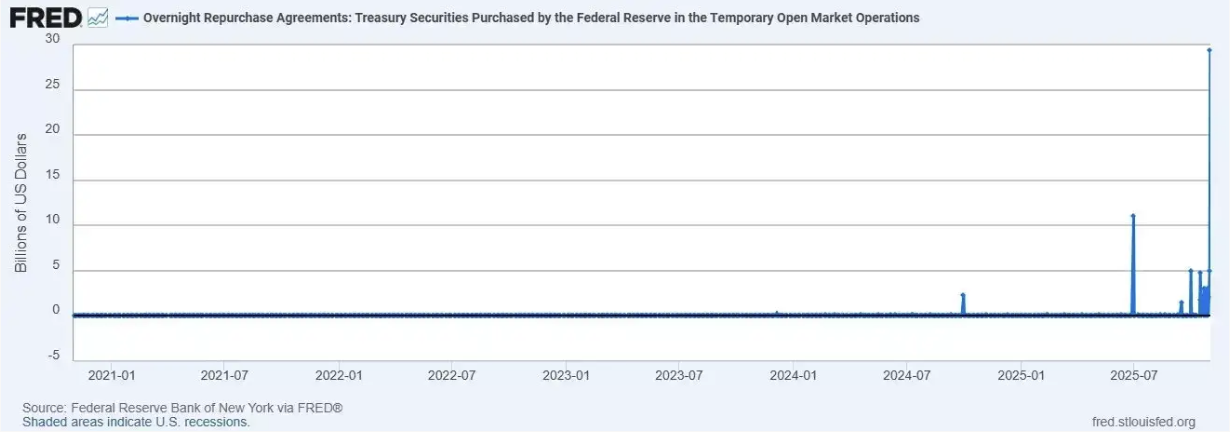

Is the Fed quietly signaling trouble ahead? Powell injects $29.4B into the banking system — biggest repo operation since 2020 — as U.S. bank reserves crash to $2.8T (The Economic Times, 4 min read)

The Federal Reserve quietly injected $29.4 billion into the U.S. banking system on October 31, 2025, through overnight repurchase agreements (repos) — short-term loans where banks exchange Treasuries for cash — marking its largest liquidity operation since 2020, according to official FRED data (code RPONTSYD). The move follows a sharp decline in U.S. bank reserves to $2.8 trillion, their lowest level since early 2019, fueling concerns about tightening liquidity and stress in short-term funding markets.

Analysts note the injection reflects the Fed’s growing effort to stabilize short-term funding markets amid stress linked to quantitative tightening and year-end balance sheet pressures

The last time the Fed conducted a similar operation at this scale was during the repo market turmoil of 2019, when overnight lending rates spiked unexpectedly

While the Fed described the move as a routine step to manage short-term rates, traders see it as a warning sign of strain in the financial system, as big banks and money market funds compete for shrinking reserves

As the shutdown drags on, here’s how it can drag down the economy (CNN, 6 min read)

The federal government shutdown, now entering its fifth week, is already wiping out an estimated $7 billion in economic output, according to the Congressional Budget Office. Economists warn that the longer it drags on, the more likely it is to break a fragile economy already slowed by high tariffs, weak hiring, and low consumer confidence. Roughly 65,500 small business contractors face $12 billion in delayed payments, while 22 million Americans could see their health premiums jump 26% as Affordable Care Act subsidies expire and 65,000 children risk losing access to Head Start programs

Consumer confidence has fallen to its lowest level since April, and if the shutdown stretches past Thanksgiving, analysts say recovery could take months

While the wealthy continue to spend, lower- and middle-income households are increasingly strained

Economists warn of a “snowball effect”: job losses, missed paychecks, and falling confidence that could trigger longer-term economic damage

US government shutdown plunges the country into a statistical blackout (El País, 3 min read)

The U.S. government shutdown, now in its 31st day, has paralyzed key federal agencies and halted the release of crucial economic data, creating what analysts call a “statistical blackout.” Institutions like the Bureau of Economic Analysis and Bureau of Labor Statistics have stopped publishing GDP and jobs figures, leaving economists and the Federal Reserve without critical visibility into the economy

Fed Chair Jerome Powell, who recently approved a 0.25% rate cut, compared the situation to “driving in fog,” saying the central bank must move cautiously amid missing data

Meanwhile, President Donald Trump continues to pressure Powell for deeper rate cuts ahead of the midterms and has intervened in federal data agencies, firing the head of the Bureau of Labor Statistics

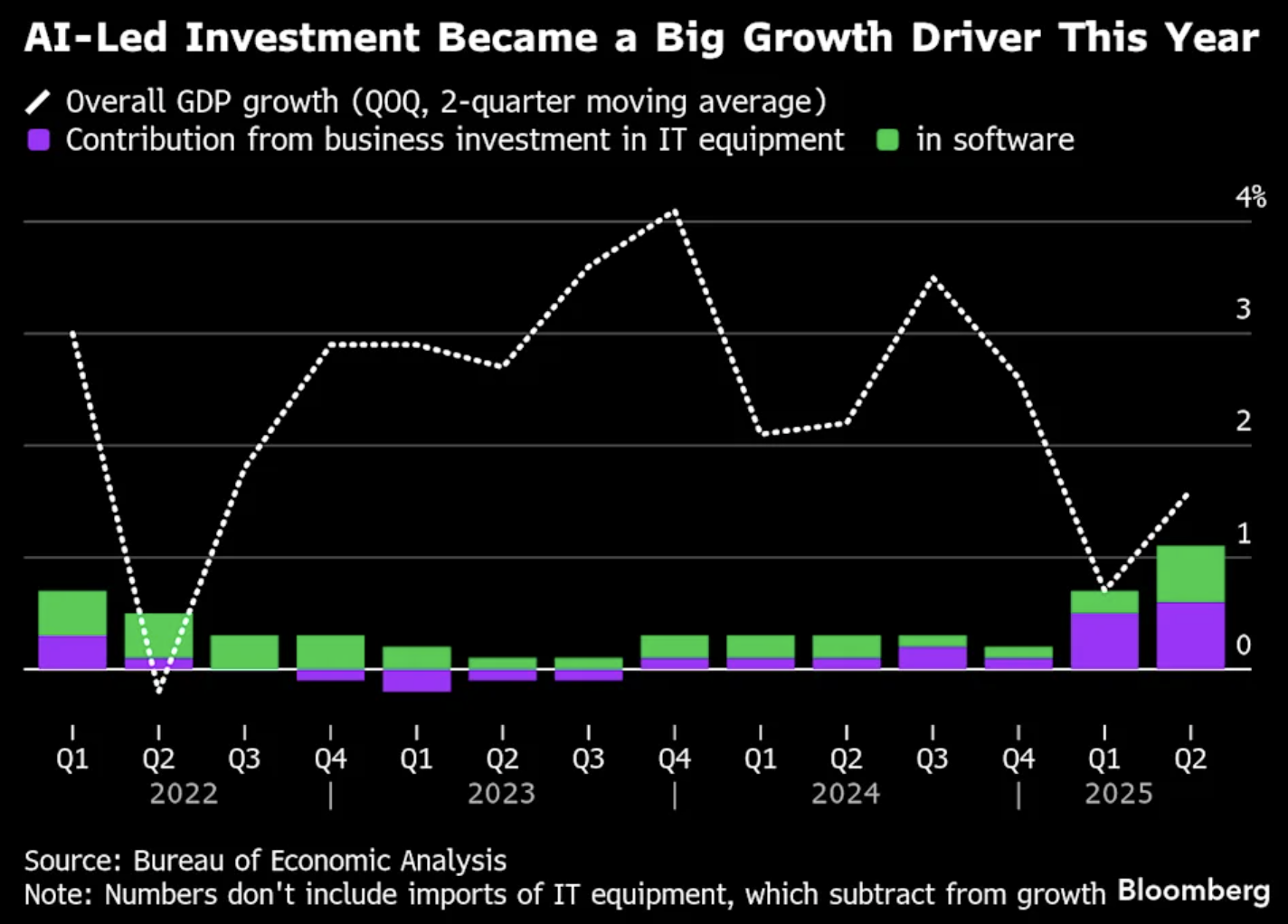

AI-Led Investments Are Driving US Economic Growth (Bloomberg / Yahoo Finance, 7 min read)

Artificial intelligence has become the main engine of U.S. economic growth in 2025, driving more than half of the country’s 1.6% GDP increase in the first half of the year. Tech giants Microsoft, Meta, and Google alone spent $78 billion on capital projects in Q3, nearly double last year, fueling booms in data center construction ($41 billion annually), software, and equipment investment, even as housing and hiring lag. Bloomberg Economics estimates AI-related spending added 1 percentage point to GDP this year and could rise to 1.5% in 2026, though Barclays warns this may be the peak

The wealth effect from surging AI stocks has created about $5 trillion in new market value, spurring $180 billion in consumer spending

Yet risks loom: power demand is projected to rise 15.8% by 2029 and tariffs are lifting infrastructure costs

Long-term, AI could boost productivity by 0.2 percentage points annually, adding 3% to GDP by 2055

The uneven impact of President Trump’s $100,000 H-1B visa fee on Silicon Valley (PitchBook, 4 min read)

The Trump administration’s new $100,000 fee on first-time H-1B visa petitions has disrupted Silicon Valley’s ability to hire global talent, particularly for large AI startups reliant on foreign engineers and researchers. The steep charge, meant to curb immigration and prioritize U.S. workers, has instead prompted many companies to pause or scale back visa programs, seek alternative recruitment channels, or expand abroad. While giants like OpenAI (9 approvals in 2025) remain active applicants, smaller startups find the process prohibitively costly and uncertain

Executives warn the policy is backfiring, as firms like Zeb are shifting operations to Canada and India, where immigration rules are friendlier

Immigration experts note that some companies are turning to TN visas for Canadian and Mexican hires, while others are simply slowing U.S. hiring and maintaining leaner teams to offset rising costs

IPO & EXITS

Navan IPO tumbles 20% after historic debut under SEC shutdown workaround (TechCrunch, 3 min read)

Navan, the AI-powered corporate travel and expense platform formerly known as TripActions, fell 20% on its Nasdaq debut, closing with a $4.7 billion valuation, down from its $25 IPO price. The 10-year-old company became the first to go public under a new SEC rule allowing listings during the ongoing government shutdown, which grants automatic IPO approval after 20 days without manual SEC review. While the rule provides a path forward amid the shutdown, it carries regulatory and legal risks if the SEC later finds disclosure issues, a factor likely weighing on investor sentiment

Navan chose to proceed since most of its filings had already been reviewed before the October 1 shutdown

Once valued at $9.2 billion in 2022, Navan had aimed for a $12 billion IPO before market conditions shifted

Navan counts Shopify, Zoom, OpenAI, and Thomson Reuters among its clients. Its AI assistant, Ava, handles about half of customer interactions, a key advantage as the company enters a volatile IPO market

Deregulation and AI fuel mega-deal rebound in 2025 (PitchBook, 5 min read)

Global M&A activity has rebounded sharply in 2025, led by a surge in mega-deals worth $1 billion or more. Through September, 435 such transactions totaled $1.7 trillion, the strongest showing since 2021. North America dominated, accounting for $1.2 trillion, helped by the Trump administration’s deregulatory stance and AI-driven consolidation across industries. The year’s biggest deal was Union Pacific’s $89 billion acquisition of Norfolk Southern, backed by President Trump, signaling a more business-friendly antitrust climate

Regulators are again allowing divestitures to settle merger disputes, reversing Biden-era restrictions, a shift that’s spurred major takeovers

AI and energy demands are fueling deal momentum and with valuation gaps narrowing, the median EV/EBITDA multiple rising to 9.7x, dealmakers are regaining confidence

While large-scale M&A surges, smaller deals have declined: transactions under $100 million fell 3.4% by count and 25% by value

WHAT A TIME TO BE ALIVE

Clean Energy VC Trends (PitchBook, 20 min read)

Global clean energy venture funding totaled $3 billion in Q3 2025, down 41% from Q2’s $5 billion but still up 27% from Q1’s low of $2.3 billion. Deal count fell to 170, marking an 11.5% quarterly drop and continuing a slowdown from the 2023 peak. For the year, the sector is on pace for $13.7 billion in total deal value, a 26% decline from 2024, reflecting lingering investor caution after policy uncertainty around U.S. tariffs and the rollback of Biden-era climate incentives

Five deals over $100 million accounted for 65% of total funding ($1.9B), led by dispatchable energy ($1.3B across 28 deals) and grid infrastructure ($1B across 64 deals)

North America led with 64% of deal value ($6.5B YTD), followed by Europe (22%) and Asia (10%)

Median pre-money valuation rose to $25.3M, and median deal size hit $8.2M, up from $5.8M in 2024

Only 24 exits YTD, down from 36 in 2024, but exit value rose to $4.4B (vs. $1.2B last year)

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team