QSBS Supercharged: New Tax Savings?

Week of August 25th, 2025

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: AI Still Rules, But SF Bay Area Steps Back (Crunchbase, 5 minute read)

Group14 Technologies (Batteries): Raised $463M Series D led by SK, with participation from existing investors. The Woodinville, WA-based company develops advanced silicon battery materials to improve energy density in EVs and electronics

Field AI (Robotics & AI): Secured $405M across two back-to-back rounds ($314M + $91M), co-led by Temasek Holdings, Bezos Expeditions, and Prysm Capital. Based in Irvine, CA, Field AI builds a “single software brain” to power robots across industrial, logistics, and commercial environments

EliseAI (AI Automation): Raised $250M Series E from Andreessen Horowitz, Bessemer Venture Partners, Sapphire Ventures, and Navitas Capital. The New York-based company provides AI-powered automation tools for housing and healthcare, helping streamline operations like leasing, tenant communications, and patient engagement

Ontic (Security Intelligence): Landed $230M Series C led by funds managed by KKR. Based in Austin, TX, Ontic develops intelligence and automation tools for corporate and physical security, enabling organizations to detect, investigate, and respond to threats more efficiently

Overhaul (Supply Chain Risk Management): Raised $105M Series C led by Springcoast Capital Partners, bringing total funding to $304M. Also headquartered in Austin, TX, Overhaul provides an in-transit risk management platform used by logistics providers and enterprises to reduce theft, delays, and compliance risks across global supply chains

What Founders And Investors Need To Know About The New Tax Code Changes For QSBS Under The OBBB (Crunchbase, 4 minute read)

The One Big Beautiful Bill Act introduces the most significant update to startup tax policy in over a decade, centered on expanding Qualified Small Business Stock (QSBS) incentives. The Act raises the capital gains exclusion from $10 million to $15 million (indexed to inflation after 2026), shortens holding periods to allow partial exclusions at 3 and 4 years, and broadens eligibility to companies with up to $75 million in gross assets

These reforms are expected to draw more capital into high-growth sectors, encourage earlier liquidity through secondary markets, and make QSBS benefits more accessible to mid- and later-stage startups

Analysts note this will likely accelerate adoption of C corp structures, increase planning opportunities for trusts and estates, and expand appeal beyond seed investors to growth equity and family offices

Industry exclusions remain (e.g., services, finance, real estate, hospitality, energy), and only U.S. C corps qualify

How long can AI agents like Cursor keep burning cash? Investors are divided (Pitchbook, 5 minute read)

AI-powered coding assistants like Anysphere’s Cursor, Cognition’s Devin, and Anthropic’s Claude Code are rapidly gaining adoption but struggling with negative gross margins. Unlike traditional SaaS, their costs don’t scale cheaply: each user session requires expensive cloud compute and LLM tokens, making freemium models unsustainable. Anysphere, valued at $9.9 billion, reportedly operates with negative margins, while rivals impose usage limits to offset “power users”

Investors are split: some (e.g., a16z) see costs as a temporary issue, while others stress margin discipline as a survival factor

Optimists argue falling compute and token costs will restore margins, and note that AI-native firms are hitting $100M ARR much faster than traditional SaaS

Like Uber and Airbnb in earlier eras, VC cash is fueling growth for now. The key question is whether costs will fall quickly enough to meet surging demand

An MIT report that 95% of AI pilots fail spooked investors. But it’s the reason why those pilots failed that should make the C-suite anxious (Fortune, 4 minute read)

Investor unease is rising over whether the AI boom is a bubble, with shares of Nvidia, Microsoft, Alphabet, and CoreWeave sliding sharply this week. The sell-off followed Sam Altman’s comments that venture-backed AI startups may be overvalued and an MIT Media Lab report showing that 95% of AI pilot projects fail to deliver returns. The MIT study, The GenAI Divide, surveyed 150 executives, 350 employees, and reviewed 300 AI projects. It found failures stemmed largely from organizational “learning gaps,” not model capability

Companies that bought AI tools succeeded 67% of the time, compared to 33% for in-house builds

The report also noted that firms often misapplied AI in marketing and sales, instead of targeting back-end cost savings. Analysts emphasized the core technology is sound—the problem lies in execution

Still, markets reacted negatively, highlighting how sensitive investors remain to signs that AI adoption may not immediately translate into profits

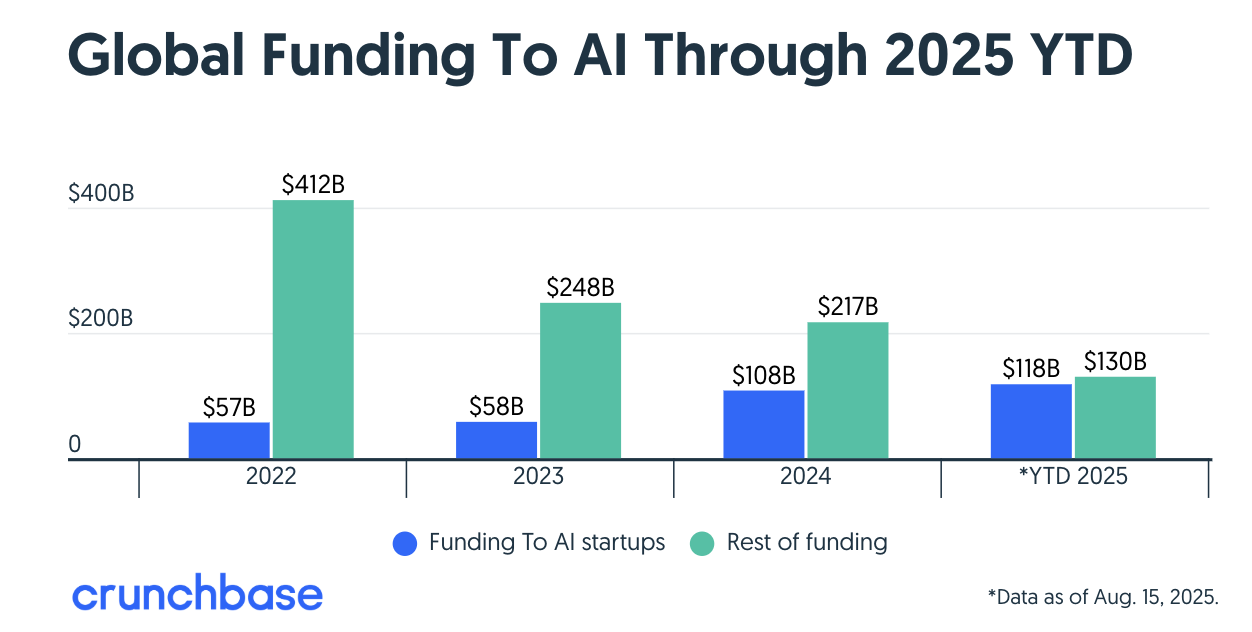

As Funding To AI Startups Increases And Concentrates, Which Investors Have Led? (Crunchbase, 3 minute read)

Global funding to AI-related companies has hit $118 billion as of mid-August 2025, already surpassing last year’s $108 billion. Nearly half of all venture funding this year (48%) has gone to AI, up from a third in 2024. Capital is increasingly concentrated: just eight companies raised $73 billion (62% of AI funding), including OpenAI’s record $40 billion round. This contrasts with 2024, when 13 companies raised $47 billion (44%)

Repeat mega-raisers include OpenAI, xAI, Scale AI, Anthropic, Anduril, and Safe Superintelligence

By comparison, billion-dollar rounds in non-AI firms made up only 4–5% of funding

The scale of these commitments is depleting U.S. venture dry powder, potentially to below 2019 levels

ECONOMIC SNAPSHOT

Fed chair Powell boosts expectation of US rate cut (BBC, 4 minute read)

Federal Reserve Chair Jerome Powell boosted expectations for a September rate cut, noting that tariffs have had “visible” effects on prices but may only cause a temporary inflation bump. Speaking at Jackson Hole, Powell said risks now tilt upward for inflation but downward for employment, warranting possible policy adjustments as rates remain in “restrictive territory”

Powell avoided directly addressing Trump’s months of public pressure, though his shift to a more dovish tone lifted U.S. equities, with the S&P 500 up 1.5% by market close

Current rates stand at 4.25–4.5%, and economists see a cut as increasingly likely, though Powell emphasized that monetary policy is not on a preset course

Analysts said a September cut looks probable, but stronger jobs data or stubborn inflation could delay action

Canada to drop some of its retaliatory tariffs on the US (BBC, 4 minute read)

Prime Minister Mark Carney announced Canada will lift portions of its C$30 billion ($21.7 billion) in retaliatory tariffs on U.S. goods starting September 1, though levies on autos, steel, and aluminum will remain. The move follows his first call with President Trump since the countries missed a trade deadline. Canada’s adjustment matches the U.S. by exempting goods compliant with USMCA, restoring free trade for most products

Still, core disputes remain: the U.S. maintains 35% tariffs on non-compliant Canadian goods and 50% tariffs on steel and aluminum imports, while Canada keeps 25% tariffs on U.S. autos, steel, and aluminum

Carney argued the deal preserves Canada’s tariff advantage—an average 5.6% rate versus 16% for other countries—but faces domestic criticism for “capitulation”

The decision comes as Ontario has lost 38,000 jobs in three months, largely in manufacturing, underscoring the economic strain

Economic Data Has Taken a Dark Turn. That Doesn’t Mean a Crash Is Near (The New York Times, 5 minute read)

The U.S. economy is showing mixed signals as President Trump’s sweeping tariffs, immigration curbs, and reduced government spending begin to filter through. Inflation has ticked up, especially on tariffed imports, while consumer spending remains resilient—though partly due to shoppers front-loading purchases before prices rise. Businesses face uncertainty: investment in new factories has slowed, foreign companies are hesitating, and mid-sized firms expect the weakest revenue and hiring growth since the pandemic

Labor dynamics complicate the picture—job creation has been revised down, but unemployment stays around 4–4.2%, partly because immigration restrictions have cut the workforce by as much as 1.1 million

Economists warn of risks ranging from soft patch slowdown to potential stagflation if tariffs drive inflation while job growth stalls

For now, markets remain buoyant, driven by AI-related optimism, but on Main Street, caution dominates

IPO & EXITS

IPO Market Outlook: Window Reopens, But Expect A Convoy, Not A Stampede (Crunchbase, 3 minute read)

The U.S. IPO market in 2025 has rebounded, with fewer deals but stronger debuts. Figma’s valuation jumped from $19 billion at IPO to nearly $34 billion, while Circle’s stock has surged more than fourfold since June, lifting its market cap above $33 billion. Analysts note these offerings reflect stronger fundamentals, cost discipline, and more measured valuations compared to the last cycle

Experts expect steady but selective IPO activity for the rest of 2025, shaped by tariff volatility and macro risks

AI remains the wild card: while it has drawn record venture funding, most pure-play firms are not yet ready for public markets

The first wave of AI IPOs is likely within 12–24 months, with early-stage startups possibly accelerating the traditional 10–15 year path to IPO if scaling continues

Powell’s hints at rate cuts may energize IPOs, venture debt market (Pitchbook, 2 minute read)

U.S. stocks jumped Friday after Fed Chair Jerome Powell signaled September rate cuts, pointing to softening job growth, slowing consumer spending, and the inflationary effects of tariffs. Investors now expect cheaper borrowing to fuel IPO momentum—with Circle and Figma’s recent strong debuts as early signs—and to encourage M&A activity and venture debt in growth-stage and AI-heavy companies

The M&A market is already robust, up 13% in H1 2025, while European acquirers—already outspending Americans in Europe—could benefit further if a weaker dollar makes U.S. targets cheaper

Still, with rates above 4%, markets remain far from the free-money era of the 2010s

Cybersecurity firm Netskope files to go public on the Nasdaq (CNBC, 2 minute read)

Cloud security firm Netskope filed to go public on the Nasdaq under ticker “NTSK.” The Santa Clara-based company reported 33% ARR growth to $707 million and 31% revenue growth to $328 million in H1 2025, though it remains unprofitable with a $170 million net loss, narrowed from $207 million a year earlier. The IPO comes amid a broader rebound in tech listings, following strong debuts from Figma, Circle, CoreWeave, and eToro

Netskope also enters a cybersecurity sector seeing major consolidation, highlighted by Alphabet’s $32B Wiz acquisition and Palo Alto Networks’ $25B CyberArk deal

Founded in 2012, Netskope competes with Palo Alto Networks, Cisco, Zscaler, Broadcom, and Fortinet

Backers include Accel, Lightspeed Ventures, and Iconiq with Morgan Stanley and JPMorgan leading the offering

E-Commerce Firm Pattern Files for IPO Showing Revenue Growth (Bloomberg, 3 minute read)

E-commerce firm Pattern Group Inc., which resells goods on platforms like Amazon, Walmart, and Macy’s, has filed for a Nasdaq IPO under the ticker PTRN, aiming to raise about $400 million. The Utah-based company reported $1.1 billion in revenue and $32.1 million net income in the first half of 2025, up from $841.3 million revenue and $22.6 million profit a year earlier

Backed by Knox Lane and Banner Capital, Pattern previously raised $225 million at a $2 billion valuation in 2021

Pattern ranks second among U.S. Amazon marketplace sellers by activity and offers inventory, logistics, and marketing services to brands

Co-founders David Wright and Melanie Alder will retain majority voting power after the IPO, led by Goldman Sachs, JPMorgan, Evercore, and Jefferies

WHAT A TIME TO BE ALIVE

‘DEI’ as a dirty word: Companies are saying a lot less about diversity and equity in public filings (Fortune, 3 minute read)

A new Conference Board report shows sharp declines in the use of “diversity,” “equity,” “racial,” “gender,” or “DEI” in corporate filings. Mentions of “DEI” dropped 68% in S&P 500 companies’ 2025 10-Ks, while over a third of S&P 100 firms eliminated “equity” entirely. Disclosures of workforce demographics also fell: reporting on women in management dropped 16%, women in the workforce fell 14%, and disclosure of board gender and race/ethnicity declined by 22% and 20%, respectively

The pullback follows Trump administration executive orders targeting DEI programs, with companies wary of legal or political risks

Experts note, however, that many firms are still pursuing diversity and inclusion internally—just with less public emphasis

Why Investing Like a Woman Could Be Crucial for Your Portfolio (Investopedia, 3 minute read)

Research consistently shows that women tend to achieve stronger long-term investment returns than men. Studies across decades—including University of California (2001), Warwick Business School (2018), and Wells Fargo (2025)—found women outperform men by 1.5 to 2.5 percentage points annually, often while taking on less risk. Key reasons include lower trading frequency, steadier long-term strategies, and disciplined risk awareness, which minimize costly mistakes and allow compounding to work more effectively

Experts note that while men are often more action-oriented and prone to frequent trading, women tend to research carefully, set plans, and stick with them

However, a gender wealth gap persists: reports show men’s 401(k) balances are still 40–50% higher on average due to pay disparities, later investing starts, and cultural differences in financial confidence

Ultimately, the most effective investors—regardless of gender—stay invested, keep costs low, and align strategies with long-term goals

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team